SQS Software attempts to break the US

4th March 2015 14:57

claims to be the world's largest specialist supplier of software quality services. The Cologne-based company makes most of its money in Europe where the economy has been sluggish for years. Still, revenue and profit grew sharply last year, and the dividend goes up by 50%.

As flagged in January, revenue grew by 19% to €268.5 million, with the January 2014 acquisition of Thinksoft, now SQS India BFSI, chipping in a sizeable €26 million. Organic growth was 7%. A lower than expected tax rate also meant earnings per share beat consensus estimates. Strip out one-off items, mostly linked to Thinksoft, and pre-tax profit leapt by 52% to €18.8 million, giving adjusted EPS of €0.43.

SQS's managed services division remains the growth engine. Revenue there was up almost a third to €120.5 million and a 260 basis-point increase in gross margin to 36.8% had gross profit up about 42% to €44.4 million, or half the group total. The order backlog is up 28% to €129 million.

But the numbers could have been even better. Organic revenue was up across Europe, where SQS generates 91% of sales, but the "challenging geopolitical environment" limited growth and the market was very price competitive in the second half in central Europe, chief executive Diederik Vos told Interactive Investor. However, the firm did, at least, increase market share and price pressure "has evaporated in the first quarter," says Vos.

"It is hard to predict what will happen this year," he added. "But we look at what purchasing sentiment, and sentiment is more positive."

And the US is increasingly important to SQS. Revenue there more than doubled last year to €12.3 million, accounting for 5% of group sales. But it's the largest market for software testing services globally and about 50% of the company's investable market. Understandably, it's where SQS chiefs will be focusing attention in the months ahead.

"2015 will be the year of the US," says Vos. And it's also where any major acquisitions are likely to be. Impressive cash conversion meant SQS ended 2014 with a much bigger than expected cash pile of €9.8 million, compared with net debt of €2.9 million a year ago and Westhouse Securities estimates of just €0.2 million. The recent acquisition of Italian firm Bit Media for €6.1 million whittles that down a bit, but there’s plenty of firepower left for a buying spree.

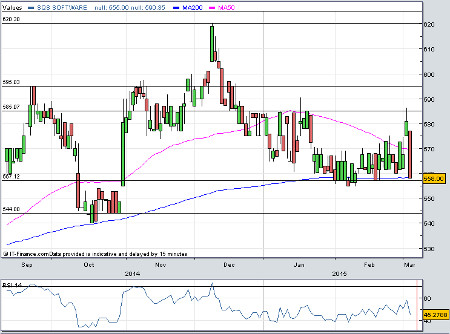

At 560p, SQS shares trade on about 15.5 times consensus forecasts for 2015 earnings. That's hardly expensive, and there could always be a positive surprise if, like this year, SQS makes more money in countries with more generous tax regimes - think India and Ireland. Management is confident enough to hike the dividend by 50% to €0.13 in line with its policy of paying out roughly 30% of adjusted profit after tax as a dividend.

Westhouse reckons the shares are worth 660p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks