Women's top stocks named

6th March 2015 16:48

by Harriet Mann from interactive investor

Share on

As International Women's Day draws nearer (Sunday, 8 March), we are all being urged to "make it happen" for gender equality. Clearly, there have been many positive changes in recent years, among them increased financial independence, but when it comes to investing, are men and women really that different?

Certainly, more women than ever are taking control of their finances, and it's a trend that's borne out by statistics compiled by Interactive Investor (II). Between 2011 and 2014 the annual rate at which new female clients opened an online trading account jumped by almost 450%, twice the annual rate of growth for male clients.

The average age of II's female traders has risen every year since 2011, too, suggesting women want to make their cash work harder and maximise their cash pot for retirement. The most popular primary trading strategy for both male and female clients on II was for medium- to long-term capital growth.

Interactive Investor's head of investment Rebecca O'Keeffe said: "Pensions flexibility, increased ISA allowances and a recognition that we’ll all need to save more is prompting more people, including women, to start saving for their financial future. But when it comes to DIY execution-only platforms, men still dominate the number of customers."

SMART investing

It pays for to be smart about your investment strategies. Women who managed their investments in line with Blackrock's SMART strategy were £48,000 better off than those who didn’t, according to the fund manager's recent Investor Pulse survey. Both groups had an average annual salary of £28,000, but SMART investors saved more, made retirement a priority, actively invested to generate income, recognised the importance of diversity and took financial planning and advice seriously.

Women at Interactive Investor are definitely starting to "make it happen," and it seems they are doing it rather well. Data from our gender defined client base* reveals that the average female portfolio is about a fifth larger than their male counterparts.

An Interactive Investor poll also appears to confirm that women perceive themselves to be more risk averse than their men. Women gave themselves an average risk rating of 5.5 out of 10 in our poll, less than the 6.3 men had rated themselves. It might be reasonable to assume that the most popular investments in male and female accounts would reflect that difference in risk perception. However, we were surprised to see no dramatic difference.

"It is fascinating that women perceive themselves to be less willing to take risk and yet appear to invest in the same assets and trade the same stocks," says O'Keeffe. "It may be that women want to take less risk and men want to take more, but the investment opportunities that are available mean that they tend to end up buying the same assets."

Top stocks

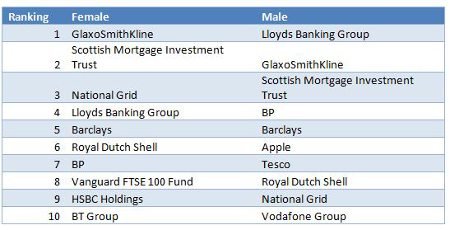

Considering the similarities, it may be easier to initially look at the differences between the ten most popular holdings. Female clients preferred the , and , taking eighth, ninth and tenth places respectively. Male clients, however, preferred - the only non-UK listed company to make the cut - and , taking sixth, seventh and tenth spot.

List of most popular equities excluding UT/OEICs

The remaining constituents in the two top-ten lists were the same, just in different orders.

Drugs giant is most popular with women, trailing by just one place in men's hearts where it occupies second spot. The market let out a sigh of relief last month as Glaxo's full-year results contained no nasty surprises after a 12 months which included a profit warning and bribery scandal. After falling to lows of 1,200p, the group has marched higher to 1,570p.

After a year as the most-bought closed-end fund, it is unsurprising that features on the list, coming second for women and third for men. With total assets of £3.7 billion at the end of January, it is the largest global generalist investment trust in the UK and aside from the private equity giant is also now the UK's largest investment trust by total assets and by market capitalisation.

A nod to their risk-averse profile, women favoured more than men, a stock from the "safe haven" utility sector. The company was ranked third most popular with women and ninth with men. But both lists featured high-yielding and , constituents of the highly volatile upstream oil sector. Both majors have slashed their capex budgets for 2015 to cope with the collapse in oil prices, but the city seems to favour the former. Brent crude has halved in value since July last year, and has stabilised, perhaps temporarily, at around $60 a barrel. As the equilibrium between supply and demand continues to balance, prices are likely to be subdued until later this year, say experts.

Banking profits

More skeletons have made their way out of the banking sector closet over the last year, but the market seems to like and . After more money was set aside to cover expected fines for foreign exchange rigging and payment protection insurance miss-selling, Barclays’ profit fell by a fifth last year. The firm is ranked fifth in both male and female lists and Deutsche Bank seems to mirror the sentiment, reckoning the shares are worth 295p.

And after a long wait, Lloyds Banking Group has finally restarted paying dividends. Some even expect a major rerating. UBS reckons a cumulative 7% dividend yield will be delivered by next year and has pencilled in a share price value of around 100p. The riskier shares are a top pick for men and are ranked fourth for women.

Little diversity was found when looking at the most-bought AIM stocks on Interactive Investor in the year-to-date, either, with topping both lists. The AIM-listed insurance outsourcer is in the middle of a company-wide tidy up to try and make its business more transparent and investible after a difficult year.

So, with little difference in the top holdings, the reason for women’s bigger portfolio pot could be as simple as females investing greater sums of money. But the difference in perception of risk aversion could also be to do with their investment strategy, says O'Keeffe.

"Women may feel that they are taking less risk by averaging-in over time and intending to hold assets for a longer period, whereas men might be keen to manage their holdings in a more active fashion, buying and selling aggressively in an attempt to time the market. Under such conditions, even when holding the same assets, men may indeed take more risk than women. Equally, it could just be that most investors fundamentally have a long term buy and hold strategy and that over time, holdings become similar.

"However, over the long term it pays to take more risk and the cumulative effect of taking on too little risk could considerably affect portfolio valuations."

*Due to customer migration a number of customers are classified as "ungendered" on Interactive Investor.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.