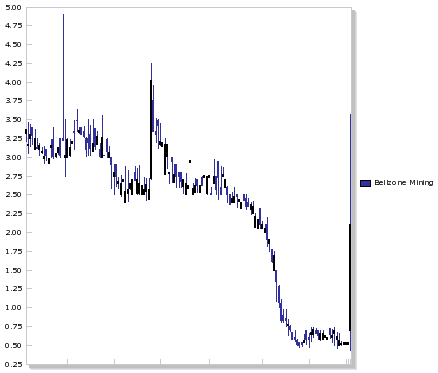

Why Bellzone Mining rose 587%

6th March 2015 17:11

by Harriet Mann from interactive investor

Share on

shares had been suspended for over five months, but returned to the market Friday after agreeing an extended loan agreement which should fund its entire working capital for 2015. That was always likely to be taken well, but just how well was a quite dramatic surprise.

Bellzone shares were suspended at 0.52p at the end of September last year pending clarification of its financial position, but gathered steam through Friday's session, rising as high at 3.57p an hour ahead of the close. Some of the steam was let off as day traders collected profits, but an end-of-day rise of about 400% is still quite remarkable.

The miner's major shareholder China Sonangol has agreed to extend Bellzone's original $4 million loan facility to the end of March 2018 and has increased it to $10 million. Drawing $5 million from the loan facility, the total it has taken out now stands at $8.5 million, leaving $1.5 million available. This extension and amendment in instead of a $30 million loan with its main stakeholder.

In a statement the company said: "With ongoing financial support from the company's major shareholder having been re-affirmed, the board of Bellzone has sought the restoration of trading on AIM of the ordinary shares of no par value in Bellzone."

But it's not out of the woods yet. The commodities rout and Ebola outbreak has caused problems for miners, especially those on AIM. When these challenges begin to thaw, Bellzone will look to find financing for its flagship Kalia project. This extended facility means it can maintain its interests in Guinea as it waits for a recovery in the market. But when this does happen, it's going to come to the market for money, which will dilute existing shareholders.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.