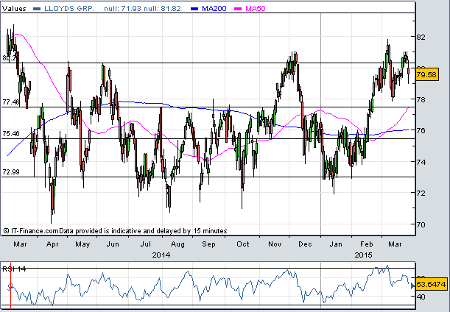

Lloyds Banking still in favour

26th March 2015 12:52

by Lee Wild from interactive investor

Share on

Hours after ditching his 'buy' rating on , Investec Securities analyst Ian Gordon has decided to keep backing high street rival . Among the best-performing blue-chip banks this year, the Black Horse is now Gordon's only remaining 'buy' recommendation in the sector, although potential upside is modest.

Much of Investec's bull case hinges on Lloyds' ability to increase return on tangible equity (ROTE) dramatically over the next three years, from 2.9% in 2014 to 8.6% this year, 11.9% in 2016 and 12.5% the year after.

"We do not believe that Barclays (Hold), HSBC (Hold), RBS (Hold) or Standard Chartered (Sell) will be capable of achieving RotE [over] CoE [cost of equity] before 2018e at the very earliest," writes Gordon.

What's more, Lloyds Common Equity Tier 1 (CET1) ratio of 12.8% in 2014 is expected to increase to 15.1% by 2017, says Gordon, adding: "we still see no barrier to a 5p pay-out by 2017e - a prospective 2017e dividend yield of 6.2%".

"On 1.4x 2015e tNAV [tangible net asset value], Buy rec and 85p RoE/CoE derived target price reaffirmed."

Clearly, government plans to sell off most of its remaining stake in Lloyds over the next year creates an overhang. It's sold a further 1% in the past fortnight and has now nearly halved its 43.3% holding, or 27.6 million shares, since 2009. Government currently owns 15.7 million shares, or 22% of the business, and chancellor George Osborne announced in last week's Budget that he would sell a further £9 billion of shares in fiscal year 2015/16, leaving a small residual stake.

"We remain of the view that the Government's accelerated plans for disposal of (most of) its residual stake will act as a drag on, rather than a barrier to, further (modest) share price progression over the next 12 months, supported by material growth in the level of dividend," says Gordon.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.