InternetQ "strikingly cheap"

31st March 2015 15:50

by Lee Wild from interactive investor

Share on

is once again receiving the attention it deserves. The owner of mobile marketing platform Minimob and music streaming service Akazoo has been growing at breakneck speed since joining AIM four years ago, but the share price inexplicably tumbled last year. It's been a different story in 2015 so far, however, and if the company keeps hitting targets it could be worth half as much again.

Revenue grew by 27% in 2014 to €132.4 million and has now quadrupled since IPO in late 2010. A 100-basis-point increase in margins to 17% drove adjusted cash profit up by 37% to €22.3 million. That's before a big increase in finance costs to €2.4 million - blamed largely on unrealised exchange differences from intercompany loans. Adjusted operating profit jumped 35% to €15.9 million and adjusted earnings per share (EPS) rose by a tenth to €0.33.

InternetQ's business-to-business, or mobile marketing, division grew revenue by 18% to €103.9 million and adjusted cash profit margin nudged 20%, raising profits by 54%. Growth is driven by rising smartphone use and a surge in mobile marketing.

Revenue rocketed by 71% at the business-to-consumer unit and Spotify rival Akazoo to €28.5 million, led by strong growth in Asia and Europe. Profit rose by 19%, although margin fell. That's because of a shift from one-off downloads to streaming subscriptions, says house broker Canaccord Genuity, although this should drive higher long-term value per customer.

"The group has, and will continue to, benefit from the ongoing adoption of smart devices and the shift to mobile advertising," says founder and chief executive Panagiotis Dimitropoulos. "We have made a solid start to 2015…the board is confident of continuing to deliver strong growth in the coming year and beyond."

Canaccord is certainly optimistic. It has upgraded revenue forecasts for 2015 by 3% to €169 million, driving cash profit up by an extra €1 million to €28.9 million and EPS to €0.428. Canaccord estimates for 2016 rise by 5% to €196.6 million, €33.1 million and €0.484, respectively.

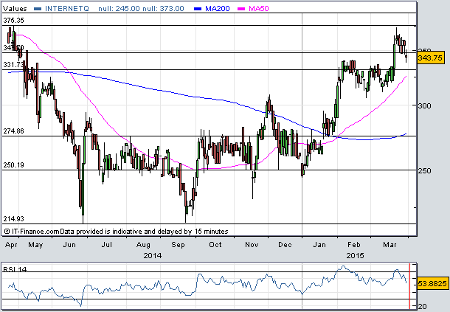

That puts the shares on just 11 times forward earnings, even after rallying by a third this year to 344p. Canaccord thinks that's still "strikingly cheap". The rating drops to 8.5 for 2016.

We've been fans of InternetQ for some time. We said the shares were a high-risk buy at 280p, then again at 294p in January when we wrote "there's a clear valuation argument in favour of InternetQ at these levels."They're now up 23% and 17% respectively.

Canaccord believes the shares are worth 528p, putting the shares on a forward price/earnings of 17 and enterprise value-to-cash profit ratio of 10 times. That's not expensive against the sector for forecast average EPS growth for the next three years of 20%.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.