Risk rises as Falkland Oil shelves well in south

13th April 2015 16:58

by Harriet Mann from interactive investor

Share on

Lower oil prices have convinced a trio of Falkland Islands oil explorers to defer plans for a second well in the southern Falkland basin, preferring instead to drill another well in the North Falkland basin. That will certainly leave in better financial health at the end of the current drilling campaign, but the decision certainly raises the stakes here.

Falkland Oil and joint venture partner Edison have agreed with Noble Energy's plan to defer another well in the south and sail north, assuming operatorship of Licence PL001, to the west of the Sea Lion field, from Argos.

FOGL boss Tim Bushell reckons that by scaling back its programme in the south, the team will have more time to analyse results from the prime "play opening" well on the southern Humpback prospect, which is due to be spudded in May. Management also hope they can take advantage of lower drilling costs in the future.

"The most interesting thing for investors in FOGL is that it has, notwithstanding success in the North, become a very serious bet on one well in the South not something I feel that the market or investors have yet grasped, this is proper risk taking," says oil industry expert Malcolm Graham-Wood.

Nestled near similar prospects totalling over one billion barrels of oil, the Humpback prospect is thought to contain between 250-650 million barrels of un-risked gross prospective resources. If the analysis looks good, the trio will fully appraise the prospect and drill other wells in the area as part of a future campaign.

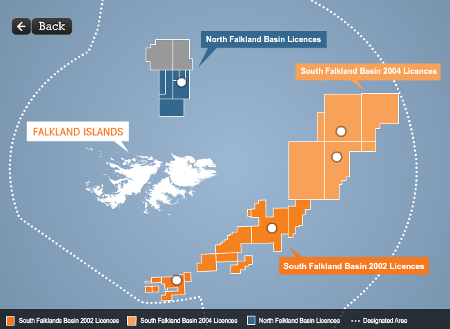

Source: Falkland Oil and Gas Limited (FOGL), Licence areas

FOGL is fully funded for the four wells in the current campaign, which includes the Zebedee, Isobel Deep, Humpback and Jayne East. FOGL has at least a 40% stake in each. The company does not have any interest in the remaining wells of the campaign; Chatham and Rhea.

Industry expert Malcolm Graham-Wood notes the benefit of the new strategy.

The one bonus for FOGL is that it does leave them in a stronger financial position at the end of the programme than was previously expected and may be one good reason for accepting Noble's offer of a reduced programme. I had been concerned that FOGL may have felt the need to top up the coffers at some stage, at least that it now unlikely, at least for a little while.

Overall, looking at the stakes at play in the Falklands at the moment, I still feel that is the way to have the best, most rounded exposure to the campaign.

The decision highlights the greater potential for commerciality in the Sea Lion field in the North, say analysts from Westhouse Securities.

The market is attributing no value to activity in the South basin and Noble's decision to farm-in to PL001 in the North, if anything, highlights the greater potential for commercial development around the Sea Lion field. The biggest beneficiary of this morning's news is obviously Argos Resources (ARG LN, n/r) but all of the other players in the North Falklands basin (FOGL, RKH and PMO) should be helped by Noble and Edison's decision to shift their focus to the North Falklands basin.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.