Goldman Sachs names oil takeover tips

15th April 2015 12:45

by Lee Wild from interactive investor

Share on

We've discussed the predicted round of oil & gas industry consolidation before. Following recommended bid for , few sector commentators have talked of little else. The same names tend to pop up pretty regularly. Now, Goldman Sachs and Jefferies add their tips into the mix.

"We expect well-funded majors and NOCs [national oil companies] to scrap high-cost, high-complexity projects and focus on gaining exposure to low-cost projects via M&A," says Goldman.

"We upgrade [target price 411p] and Africa Oil to Buy from Neutral, believing that both offer exposure to strategic assets which sit low on the cost curve. Other Buy-rated stocks screening as potentially attractive M&A targets are and ."

It would make sense for the majors and state-run oil companies to scrap marginal developments, which need at least $80 a barrel oil to breakeven, and buy up projects lower on the cost curve currently owned by smaller explorers, it says. "We see projects with between five and 10mn bls/d of potential peak production, currently in the hands of the E&Ps, which could be transferred," says Goldman.

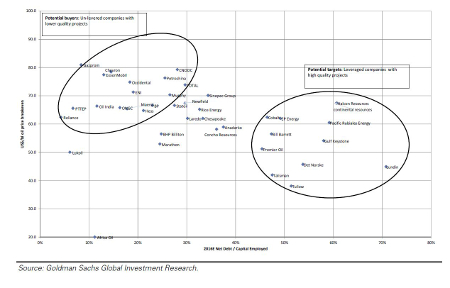

Potential buyers and potential targets are neatly summed up in the graphic below.

However, the team at Jefferies have slightly different ideas.

They reckon that rather than an anticipated "M&A frenzy," it is value and strategic rationale, rather than oil price outlook, which will be the true driver of deals.

The broker says Oil & Gas sector corporate transactions since October 2008 show a "steady spread of deals rather than a 'frenzy' at various times".

"The E&P weighted average of ~$16/boe [barrels of oil equivalent] for 2P reserves (15 deals) reduces to ~$13/boe including the two (yet to complete) IOC [international oil companies] deals. Crucially though, the targets fell to significant discounts ahead of bids, allowing sufficient premiums (49% on average) to get the deals over the line."

This causes Jefferies to look for stocks trading at a sufficient discount to $16/boe to allow a satisfactory bid premium, and with a clear de-risked asset (2P reserve) base or strategic rationale.

"We would argue that the most discussed M&A candidate of current and past years - Tullow Oil - does not come close to passing this screen and in our view the current renewed M&A hype surrounding the name is unfounded," says the broker. "Trading at $22/boe of 2P reserves and with mainly East African 2C resources unlikely to convert to reserves anytime soon (and expensive in contrast to partner Africa Oil) the value argument does not stand up and we remain sellers of this stock."

So, who is cheap?

"At the 'cheap' right-hand side of the charts Kurdistan and LNG resources dominate. We would point to $4.5/b for Kurdistan 2P reserves & $2/boe for 2C LNG resources as precedent deal metrics," writes Jefferies.

It likes Genel, but points out that all the Kurdistan names - including and Norway's DNO - operate under a high government take fiscal regime, which contributes to historic deal metrics at sub $5/boe of 2P reserves. "Value can be found in these names but it is relative, i.e. not comparable to the $16/boe metric in other areas."

Elsewhere, shows as the cheapest stock on a 2P+2C basis at US$1.1/boe, although, similar to Kurdistan, "value is relative for LNG contingent resource also".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.