Surging CDialogues is high-risk, high-reward

21st April 2015 13:50

by Lee Wild from interactive investor

Share on

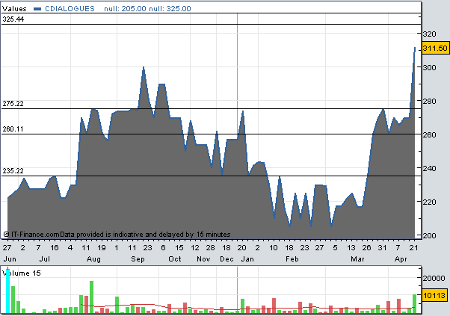

It's been listed on AIM for less than a year, but mobile marketing services firm has done better than many other IPOs. Admittedly, much of that outperformance has come during the past seven weeks when the share price surged by 59%, but full-year results have beaten numbers flagged up in January, there's a maiden dividend, and the shares trade on very modest valuation multiples.

CDialogues, which raised £1.25 million in June from a placing at 212p, said in January that full-year revenue would exceed €9.5 million (£6.82 million) and cash profit reach €2.7 million. In fact, sales jumped by 117% to €9.9 million and profit soared by 87% to over €2.9 million. Pre-tax profit rocketed 89% to €2.6 million.

Importantly, free cash flow, after development costs and capital expenditure and excluding one-off items relating to the AIM listing, doubled to €1.2 million, bolstering the net cash position of €2.4 million at the end of 2014.

This result is all the more remarkable given its previous dependence on Zain, Iraq's leading mobile telecoms provider which accounted for almost 90% of revenue in 2013. CDialogues exited Iraq in December - the country chipped in 15% of November's revenue.

The company provides mobile marketing services to mobile network operators (MNOs) in emerging markets, mainly the Middle East, but also in Vietnam. The idea is to help them grow revenues and stop clients leaving for other providers - so-called churn. Mobile users pay a daily subscription fee for regular mobile content via SMS from CDialogues' platform. That money is then split between the company, its local partner, and the mobile provider.

Last year, CDialogues operated eight mobile marketing projects in five countries to a subscriber base of 35 million customers, up from 15 million in 2013. This included over 5.5 million unique subscribers and generated total gross billings of more than $50 million.

"We have started the current year well and the nature of our model means that we already have good visibility on revenues based on current contracts," says chief executive Pale Spanos. "We are well placed to continue to grow customer numbers under existing contracts and also to add new customers in new geographies."

With global mobile connections tipped to hit 8.1 billion in 2018, and annual mobile service revenue forecast to reach $1.1 trillion, growth at CDialogues will come from an expanded contract base, extending regional clients relationships and investing in its technology platform.

Allenby Capital like the valuation. "Given the scalable business model and forecast top line growth of over 30% in 2015, we feel the current valuation of 6.8 times 2015 EPS is attractive and we expect the shares to rally post today's announcement." They did, rising as much as 24% to 325p.

Even at the current 311.5p, CDialogues shares trade on only 7 times forward earnings. Yes, working in these countries is higher risk as Iraq demonstrates, but management has successfully diversified elsewhere, and there's both good revenue visibility and strong cash conversion. Not for widows and orphans, but certainly one to watch.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.