Advances have investors eyeing UK biotech bounty

22nd April 2015 15:32

by David Prosser from interactive investor

Share on

Many of the most important advances in modern healthcare have been made by UK researchers and laboratories - one only has to think of Edward Jenner's vaccine for smallpox almost 250 years ago, Alexander Fleming's discovery of penicillin, or Francis Crick and James Watson's discovery of the structure of DNA.

Steve Bates, chief executive at the UK's BioIndustry Association, argues that the trend continues to this day. He says: "The UK is one of the best places in the world for life sciences. It's on a par with premier life science centres such as Boston, San Francisco, San Diego and Singapore.

"We have four of the top 10 universities in the world, 19 of the top 100 universities, one of the world's three major financial centres, a stable of quality service providers, world-class charitable supporters of the industry and a rich heritage of globally recognised medical research."

US focus

That said, funds investing in healthcare and life science companies typically have a global outlook. While the most successful healthcare funds generally have some exposure to UK businesses, they tend to focus on US companies. The US has many more publicly listed businesses, particularly in biotech but also in the pharmaceutical sector.

However, Bates's flag-waving is not misplaced. The UK's life sciences sector is generating tremendous excitement about both the healthcare advances it is making and their commercial potential. Moreover, UK companies are benefiting from the same global trends in healthcare as their US peers.

Above all, says Sven Borho, a partner at OrbiMed Healthcare Fund Management, the pharmaceutical sector is currently benefiting from a more exciting pipeline of new drugs and treatments than it has at any time in living memory.

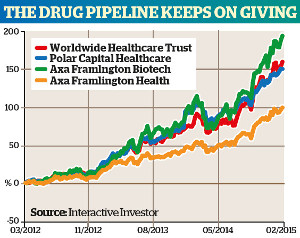

US-based OrbiMed manages the portfolios of two UK-based closed-ended funds, and . Both enjoyed a stellar year in 2014, posting returns of around 40%, thanks to the drug pipeline.

Blockbuster year

"Last year was the year of the biotech blockbuster drug launch," says Borho. "We are now seeing the innovation we've always known about in this sector really coming through. Eight of the top 10 selling drugs in the world next year will be derived from biotechnology."

At Polar Capital, fund manager David Pinniger is also thrilled by recent breakthroughs in healthcare and the potential for new advances in future. "The quantity and quality of the new medicines coming through in several different areas is incredibly exciting," Pinniger says.

"When the human genome was mapped 15 years ago, it prompted a huge wave of investment in health and biotech, and that is now beginning to pay off."

Pinniger points to advances in immunotherapy as especially exciting. This new technology has aided the development of new drugs that combat cancer by targeting tumours specifically - a huge advance on the chemotherapy that kills healthy cells and cancer cells alike.

He is also impressed by developments in the area of fibrosis, where new drugs for treating patients with lung or liver disease look promising, and by advances in the battle against rare genetic diseases.

Such advances pushed up valuations in the healthcare sector last year, as did merger and acquisition activity in the sector as large pharmaceutical companies jockeyed for position in each new area of interest.

Add in the effect of "skyrocketing healthcare spending in emerging market countries", says Sven Borho, and you can see why the sector performed so strongly. The MSCI World Healthcare index rose by 19% during 2014, while the MSCI World Biotechnology index was up by more than 40%. The FTSE All-Share index achieved a total return of just 1.2% during 2014.

The good news, argues Andy Parsons, head of investment research at The Share Centre, is that there is every reason to be confident looking ahead. "We believe advances in medical and healthcare technology will continue at a rapid pace due to ageing populations, obesity and the demand in and rising wealth of emerging economies," he says.

Linden Thomson, manager of the , agrees. "While remaining conscious of the risks inherent in research and development, we remain bullish on the sector in 2015," she says. "Maintaining current valuation multiples suggests we could see 20%-plus growth in the sector."

UK biotech firms poised to prosper

So which UK businesses are best placed in the sector? Pinniger says the environment for innovative healthcare companies in the UK is improving rapidly, with institutional investors increasingly keen to provide the sector with the funding it needs to develop. "I think the window for UK biotech companies can open up over the next couple of years," he says.

The future is not just encouraging for the minnows; the UK's giant pharmaceutical companies remain much in demand with investors.

One such investor is Neil Woodford, the much-followed star manager, who last year left Invesco Perpetual to set up his own investment business, Woodford Investment Management. Its flagship top 10 holdings include both and . The latter is Woodford's single biggest holding, accounting for more than 7% of the portfolio.

"Some people haven't liked AstraZeneca for years," Woodford said last year. "People were calling the management lunatics for the level of spending committed to research and development, but I didn't think they were lunatics, and now it is paying off.

"The key to the valuation of AstraZeneca is its pipeline of new drugs. It is immersed in technology, but people don't regard it as a technology stock because it doesn't have a bloke in jeans and a T-shirt representing it."

The pipeline Woodford points to very much reflects some of the themes fund managers such as Borho and Pinniger are so excited about. AstraZeneca has a world-leading immune-oncology portfolio, with 13 drugs already in clinical trials and another 16 at the planning stage.

With a market capitalisation of around £60 billion, AstraZeneca is a huge business - second only to GlaxoSmithKline in terms of size in the UK pharmaceutical sector.

But there are opportunities further down the scale too. Martin Wales, an equity analyst at M&G Investments, says: "As the sector is less developed in Europe than in the US, companies with similar positive attributes often appear to be valued quite differently, and a number of large biotech companies have only just begun to gain traction with investors. One is , a UK-based biotech company that develops and commercialises cannabinoid medicines."

GW Pharmaceuticals, currently valued at around £1 billion, is far smaller than AstraZeneca, but still a sizeable business. It's a speciality pharmaceutical company best known for developing drugs based on a range of chemical compounds extracted from varieties of the cannabis plant.

Further down the scale still, David Pinniger points to AIM-listed as one to watch. The business is active in the battle against genetic diseases and has begun clinical trials of a new treatment for muscular dystrophy.

Another UK business worth mentioning is . Founded in 2002, the company is now a world leader in tests for latent tuberculosis, for which the global market is immense. The stock of this NASDAQ-listed company has a rising investor fan base.

Among unquoted biotech companies, industry insiders tip a number of UK firms closing in on an IPO over the next year or so - and worth considering once they announce. These include drug discovery group Heptares, and Immunocore, which has done work on activating the body's immune system to kill cancer cells.

Fund routes to biotech opportunities

The UK boasts several world-leading funds that offer exposure to the biotech sector, including Money Observer Rated Funds AXA Framlington Biotech and Worldwide Healthcare investment trust.

At the Parsons picks out two. "The is now managed by Mark Hargraves. The investment focus is split across themes such as healthcare services, pharmaceuticals, devices, biotech and speciality pharma," he says.

" is co-managed by Dan Mahony and Gareth Powell, whose team has more than 60 years' industry experience. Key investments focus on healthcare equipment, biotechnology and pharmaceuticals."

Woodford has become an evangelist for UK biotechs and on Tuesday (21 April) launched , a specialist closed-ended fund, that will include unquoted companies in the sector.

The oversubscribed launch raised £800 million and began trading at an instant share price to net asset value premium. Woodford has limited experience investing in unquoted firms, but few would bet against him succeeding.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.