US sage calls time on shale industry

6th May 2015 10:49

by Lee Wild from interactive investor

Share on

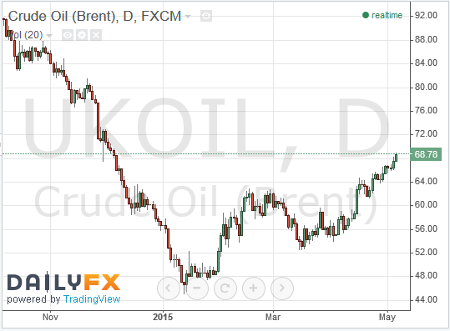

Oil prices have risen again, this time to their highest levels in 2015, so far. Brent crude has just hit $69 a barrel for the first time since December, and there is, it seems, every chance prices could go higher still.

It's something predicted by Mark Henderson, an analyst at Westhouse Securities, when we talked to him last month. Then, Henderson told Interactive Investor: "The oil price could be at $80-plus within the next six months. It could even be more." That prediction now appears less radical than it did three weeks ago.

A key tenet of Henderson's theory hinges on shale production in the US. A new shale oil well can produce an average of 600-700 barrels of oil a day. But these wells do not yield positive free cash in their first 6-12 months, even at an $80 a barrel. Output tails off very quickly, too, and production can halve over the next 6-12 months. It's why shale players must keep drilling fresh wells.

But the US government tips the domestic shale oil industry - responsible for about half of US output - to record its first monthly dip in production since records began in 2013.

Now, David Einhorn, one of the few people to have accurately and very profitably predicted the US real estate and subprime crises, has directed his penetrating analysis to the US shale oil industry. In a presentation at the Sohn investment conference in New York City, he lays bare the naked truths about the economics of US shale oil.

"We object to oil fracking because the investment can contaminate portfolio returns," says Einhorn, the founder of hedge fund Greenlight Capital. "The banks are clearly incentivised to enable the frack addicts."

"A very entertaining and compelling presentation, which in our view, demonstrates that US oil production will stall and potentially reverse as some semblance of economic rationality returns to the industry," says Henderson. "With very little, if any, production growth being delivered elsewhere in the non-OPEC world, we believe it is only a matter of time before oil prices resume their long-term upward march."

"According to Einhorn's analysis, the step changes required re spend and yield are unlikely to be achievable," Henderson adds. "He also ironically highlights, as he did in his critique of the subprime crisis, that bankers have fuelled the flames of the unbridled growth in US shale oil drilling by lending indiscriminately in a bid to earn massive bonuses (without any risk to themselves)."

Einhorn shared a useful rule of thumb with attendees at the conference: "When someone doesn't want you to look at traditional metrics, it's a good time to look at traditional metrics."

"The frackers' Wall Street story demands that they keep spending in a desperate effort to grow or at least maintain reserves and production, even though that spending destroys value. Their alternative, like St. Joe did after the housing boom ended, is to stop spending, which would end the charade."

Click here for the full presentation.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.