Latest potential takeover targets named

6th May 2015 17:58

by Lee Wild from interactive investor

Share on

In 2014, $2.8 trillion of corporate deals were completed worldwide, an increase of 37% on the year before. It could hit $4 trillion in 2015 if the relationship between global equities and merger and acquisition (M&A) activity is restored, argues broker Citigroup.

"We see SMID [Small & Mid Cap] names as a natural beneficiary from the potential upswing in global M&A activity, as actual or anticipated targets drive a re-rating," Citi writes in an 80-page research note on major themes for 2015.

"Strong FCF [free cash flow] and balance sheet scope are useful proxies to play this theme, with the added benefit that companies which are undervalued, capable of cash returns or enhancing acquisitions are also surfaced by the [stock] screen."

There are plenty of large-caps looking to complement their organic growth from bolt-on acquisitions, and perceived potential M&A targets can benefit from a re-rating.

"Whist screening for M&A targets is difficult, arguably companies with a good FCF yield are not only undervalued but could also be targets for potential acquisitions (particularly by private equity), especially if balance sheet scope is not being utilised in M&A or through returns of cash," explains Citi.

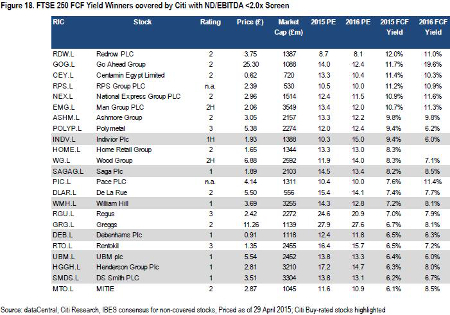

It's screened for FTSE 250 companies with an estimated full-year 2015 FCF yield of over 6% and net debt/cash profits of less than two times. The broker does, however, point out that on the flipside, the same characteristics which qualify these companies as "targets", could also tag them as "acquirers"; that is strong cash generation and balance sheet strength limiting the potential re-rating from M&A theme.

Citi 'buy' rated stocks thrown up by the screen (see below) include , , , , , and . One of the companies included on the list, , is already subject to a bid.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.