Which asset bubble will burst first?

15th May 2015 13:22

by Lee Wild from interactive investor

Share on

Property bubbles, bond bubbles, equity bubbles, commodity bubbles - history is littered with overpriced assets which have eventually gone pop. Predicting precisely when an asset bubble is about to burst is almost impossible. A 30-year bull-run in bond markets was about to implode three years ago. It didn't. A top was called on London house prices a decade ago. Wrong! Now we're talking about an end to the commodities supercycle and six-year rally in global equities. But should we be worried?

Previous ageing bull markets have been associated with asset price bubbles, often based around a convincing idea and fuelled by excess liquidity. The new paradigm of this cycle is likely secular stagnation - where growth, inflation and interest rates stay low for a long time.

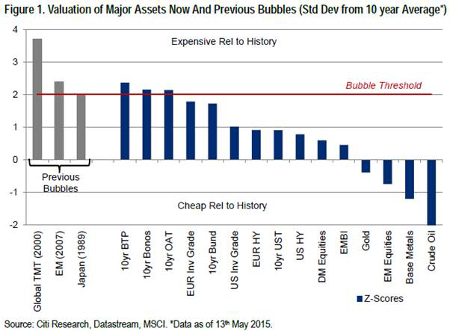

"The obvious bubble candidates right now are to be found in the fixed income markets," says the Global Strategy Team at broker Citigroup. "European fixed income markets seem most euphoric. Valuations here are around two standard deviations expensive relative to history. US Treasuries and HY [high yield] bonds do not look so stretched, trading around one standard deviation above the mean."

But even here, it's too early to call the end of the secular stagnation trades, argues Citi. "The combination of demand/supply imbalance and low inflation are likely to keep government bond yields low for some time yet."

It is rate hikes which eventually burst bubbles, but typically not until the third increase is the impact felt. The Federal Reserve is tipped to begin its monetary tightening cycle later this year, but a third rise in borrowing costs is not anticipated until the third quarter of 2016. "In the meantime, expensive stocks may keep getting more expensive," Citi analysts warn.

In equity markets, both the S&P 500 and FTSE 250 are up three-fold since 2009 to record highs, the Dow Jones is up 175%, and the has doubled to around 7,000. Investors are naturally cautious when markets break new ground, when there is no longer a visible, historic target to the upside. But even now, talk of a bubble seems premature.

"Outside some local hotspots, global equities do not yet look as stretched," reckons Citi. "In fact, the risk for bubble-fighting contrarians and value investors is that stocks join bonds in overvalued territory."

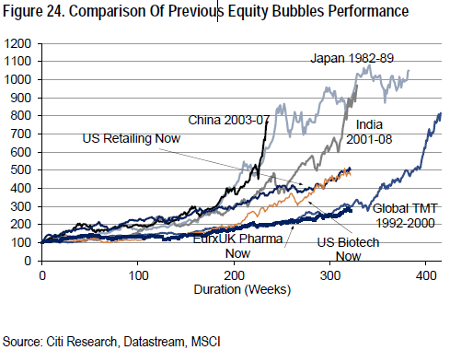

Remember, valuations in Japan traded at two standard deviations from the 10-year average in 1985, four years before the bubble burst. It was the same for global TMT (technology, media & telecoms) until the dotcom bubble burst spectacularly in the early 2000s - Biotech, which looks very hot right now, would have to rise another 70% from here to match performance of the TMT bubble.

According to Citi's research, consumer-related industries seem most expensive, with retailing, consumer durables, consumer services and food & beverage now trading above its bubble thresholds. Global pharma, media, and transportation are close. Energy, banks and materials are cheapest. "Patient investors who are wary of being sucked into bubbles should probably stick with these out-of-favour sectors."

Geographically, the US is the hottest equity market around, while Continental Europe is getting expensive. Domestically, UK consumer discretionary stocks also look dear. "Those looking for cool (ie cheap) stocks should be focusing their attention in emerging markets," says Citi.

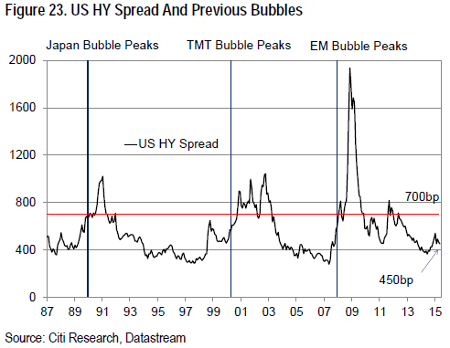

The best lead indicator that a move into a "potentially catastrophic" Phase 4 bear market is imminent is credit spreads, notes Citi. "Previous moves in US HY spreads above 700bp have indicated that a Phase 4 bear market is imminent and bubbles set to burst (see chart below)."

"The current spread of 450bp supports our suspicion that it is right to be looking out for equity bubbles, but too early to start fighting them. The move into Phase 4 marks the start of the equity bear market with the bubble leading the sell-off. Chasing bubbles in Phase 3 is lucrative but potentially catastrophic in Phase 4."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.