The insider: Rank, Topps Tiles, Countrywide

22nd May 2015 12:51

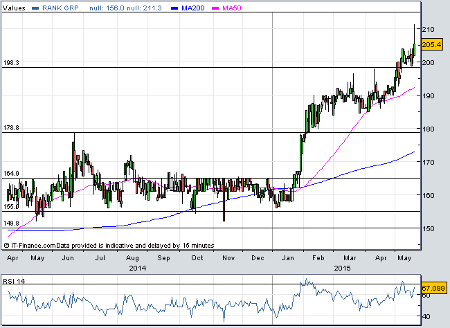

Big bets on Rank recovery

Casino and bingo club owner is still recovering from a big profits warning in October 2007 following bans on smoking in public places and popular Section 21 gaming machines from bingo clubs.

But the share price has steadily improved from less than 50p in 2008 to 210p this Friday, an eight-year high. Latest gains have been driven by news that like-for-like revenue has grown by 5% in the first 20 weeks of the second half ended 17 May, and by 4% for the 46 weeks since the previous June year-end - the Grosvenor Casinos business is up 7% and Mecca bingo 3%.

"The group's performance continued to improve in the 20-week period, with our digital channels performing particularly strongly driven by improvements in marketing, retail cross-over and product development," said chief executive Henry Birch. Full-year results, due on 20 August, should match forecasts.

And former man Birch, in the top job at Rank a year now, is backing the ongoing recovery with a maiden share purchase. He's just spent £205,000 on 100,000 of them at 205p each. Finance director Clive Jennings joined the boss and bought 25,000 shares at the same price.

Topps Tiles chief's £160k paper profit

shares have surged by almost a quarter since the Tories won the general election earlier this month. They're now back at levels last seen 14 months ago, but that's not put off chief executive Matthew Williams.

Head honcho at the specialist tile retailer since 2007, Williams has just splashed out almost £1.3 million on shares in the company he joined in 1998, shortly after its IPO. One million shares cost Williams 127p each, and he now owns 1.7 million in all. His wife owns a further 33,000 shares.

At 143p, Williams' latest purchase has made a paper profit of £160,000 in just two days. It came as Topps said market share gains had driven first half revenue grew up by 6.4% to £104 million, or 5.3% like-for-like. Adjusted pre-tax profit jumped 14% to £9.1 million. Like-for-like sales are up by 5.1% in the six weeks to 9 May.

Countrywide gives mixed messages

Three weeks ago, estate agent reported reasonable first-quarter results. A 2% drop in revenue was better-than-expected, and the company thinks it will make up for the election impact on volumes during the second half.

"The momentum in our Lettings and Commercial divisions, the anticipated future recovery in market transactions together with the results from our 'Building our Future' Programme put us in a position to create significant value for shareholders in coming years," says chief executive Alison Platt.

And Platt, poached from health insurer Bupa last year, has just paid nearly £250,000 for 41,700 Countrywide shares at 595.5p each, close to a one-year high.

However, Grenville Turner, the man she replaced after seven years in the role, has just offloaded 300,000 shares at the same price, netting almost £1.8 million. He still owns 111,226 worth a further over £660,000.

But both a buyer and seller could make a valid case for their actions at these levels. Following a post-election rally, Countrywide trades on 14 times forward earnings. Before polling day, broker Panmure Gordon thought 11 times was "not especially cheap". Still, there is a prospective dividend yield of nearly 5% to put a smile on shareholders' faces.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks