Housebuilder target prices up by as much as 26%

26th May 2015 10:43

by Lee Wild from interactive investor

Share on

Despite rocketing in value over the past four years, and more recently post the favourable general election result, the rally among UK housebuilders is not over, according to one bullish analyst.

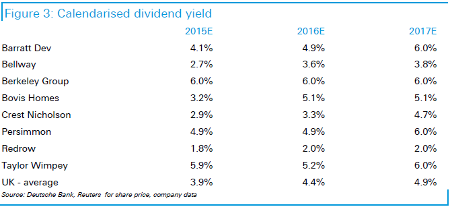

Earnings are well underpinned, with house price inflation giving scope for further growth, says Deutsche Bank. Data on mortgage lending suggests the housing market remains robust, government support is unwavering as it struggles to hit housebuilding targets, there's no risk from currency or oil prices, and dividend yields are becoming more meaningful.

Now, having previously argued that price/net tangible asset value (P/NTAV) is the best way to value the housebuilders, Deutsche has adapted its methodology to accommodate yield - industry dynamics are driving growing confidence in the size and sustainability of dividends, and three stocks feature in the top 15 FTSE100 dividend payers.

(click to enlarge)

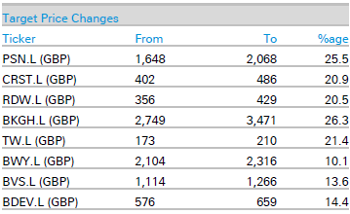

"With our new share price targets for the larger stocks now including a view on dividend yield, our share price targets suggest an average of 11% upside for the sector," says Deutsche.

"For those stocks paying strong dividends (, , , and ) we now base our price target on a simple average of the share prices implied by our P/NTAV calculation and dividend yields moving to 4%."

"For those focusing on growth rather than prioritizing cash returns to shareholders (, , ), we have rolled forward our valuations to 2017, but remain focused on P/NTAV."

(click to enlarge)

Taylor Wimpey and Barratt remain among Deutsche's three sector 'buys', seeing further upside for those valuing solely on dividend, with both stocks "well positioned to benefit from strategic and government sourced land respectively providing comfort on longer term returns". Bovis (buy) is the broker's growth stock of choice.

Although Berkeley Group shows the greatest upside to its target price, Deutsche remains nervous about the London housing markets and keeps its rating on the stock as 'hold'. It has the same rating for the rest of the sector.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.