Why Zoopla is worth 63% more

28th May 2015 12:57

by Harriet Mann from interactive investor

Share on

Acquisitions carry risk. Get it wrong and you've wasted valuable cash. Get it right, however, and the business has a new revenue stream and the potential for substantial cost savings, or "synergies" in corporate speak. Clearly, acquisition of price comparison site uSwitch has fallen into the second category, and analysts at Jefferies think the shares could be worth two-thirds more.

Last month's £190 million purchase has certainly been well-received. In 2013, uSwitch had 42% of the energy price comparison market and around 54% of the communications price comparison market. In addition to the listings and research offered by property portals, the acquisition gives Zoopla's customers the opportunity to manage how much they pay for utilities, communications and financial services. It also gives Zoopla exposure to customers not looking to move home, providing additional revenue.

The analysts expect big things from the acquisition, believing it has raised the standard of property portals in a way that can't be matched by rivals. They also see this as a precursor for further expansions into removals, conveyancing, and the skilled trade markets, the success of which will be pinpointed on trust.

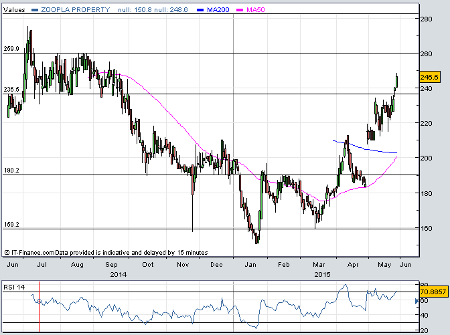

(click to enlarge)

"We believe that Zoopla will benefit from trust synergies," reckons Jefferies. "Amazon began life as an on-line book seller building trust between itself and its customers and now retails on-line virtually every product one can legally procure. We believe that Zoopla can benefit in a same way, if you trust Zoopla to help you with the biggest purchase you will ever make, why not trust Zoopla to help you with managing the home once purchased."

Putting pressure on property portals, the launch of agent-run OnTheMarket.com has shaken things up and left the market nervous. With claims that 90% of Zoopla's members have left to join OTM who can blame it, but Jefferies argues that the speed of Zoopla's losses and OTM's gains is slowing. If the newcomer fails to be the second biggest property portal by the end of the year, it will add clout to Rightmove's presence.

"Whilst we accept that most of the OTM members were unhappy with the Rightmove (RMV)/Zoopla duopoly, we suspect they would find that preferable to a RMV near monopoly. Should OTM look like missing its target we suspect that those agents that left Zoopla will return to encourage a more equal level of competition in the market."

Jefferies has upped its forward sales forecasts for Zoopla to £93.5 million, earnings to £40.6 million and pre-tax profit to £37.6 million, with a dividend of 2.7p per share. The payout should jump to 4.14p per share in 2016 with profit of £60.3 million. At 240p, Zoopla trades on 32 times forward earnings. That looks quite full, but it is in line with the market and does drop to around 19 for 2016 compared with on 22 times.

"Our price target is based on discounted cash flow and therefore has been impacted by the changes to our estimates, as a result of these changes our price target moves from 269p to 400p, an increase of 52%," says Jefferies.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.