Small-cap rockets: Double or quits?

26th June 2015 15:58

by Andrew Hore from interactive investor

Share on

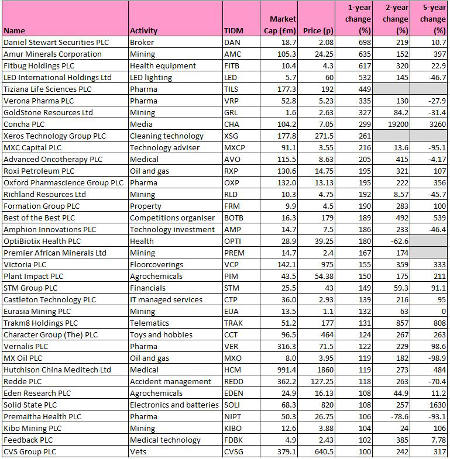

As ever there has been a mixed performance among the constituents of the FTSE AIM All Share index over the past year, but 36 of them, or 4% of the index, have at least doubled their share price over the period. Taking purely this index into account means that many, but not all, of the tiny more speculative companies, where someone buying a few shares can double the price, are excluded.

Generally, the top few of the best performers over a year tend to be dominated by companies that no sensible investor would ever have invested in at the beginning of the period. The best performer of all, AIM broker , where the share price is eight times the level it was one year ago, is an example of that.

Trading in Daniel Stewart shares was suspended for much of the period because of its failure to publish its results and its dire financial state. That uncertainty about its future was why the share price fell so far. A fundraising combined with stakebuilding by Rob Terry, of infamy, who took his stake to 9.99% - any more and he would have to be approved by the Financial Conduct Authority (FCA), helped the share price bounce. Terry's new vehicle is Quob Park Estate and has taken a 3% stake in , where the share price has more than doubled in a matter of days. However, in that case the share is just back up to the level it was one year ago.

China-based LED lighting firm was also in financial difficulties and potential investors in a placing had not paid up in early 2014. By the summer, a fundraising and capitalisation of loans had happened and part of the business sold. A proposed acquisition has proved tricky to complete. LED is an example of how a share price can rise on the back of low trading volumes. In July 2014, £179,000 worth of shares were traded, but this fell to £38,000 in August and £90,000 in September.

Some of these companies have been plugging away, been forgotten by investors and then have suddenly been rediscovered and gained a rerating. Two months ago the share price of , which organises competitions to win luxury cars, was barely above its level in June 2014, but a delayed reaction to a positive trading statement and the subsequent announcement of the full-year figures led to a surge in the share price.

As well as more than doubling in value, Best of the Best paid a special dividend of 14.5p a share (£1.32 million in cash) in December. It still has £1.9 million in the bank. The business has moved from dependence on airport-based promotions to generating the majority of revenues online. The historic profit multiple of more than 25 appears to fully value Best of the Best for the time being, though.

Shells surge

There are identifiable groupings in the list. For example, eight of the companies could be classed as having been shells, or about to become one, at the beginning of the period. Technology adviser reversed into a former technology shell and is also adviser to another shell, , as well as owning 24.3% of the latter.

is the only one of the shells yet to make a significant acquisition. It has been accident prone with its past investments, but controversial director Chris Akers has a following. The other former shells are , , , and .

The share prices of the majority of these former shells have slumped over a five-year period, but that reflects that they were different businesses back then and their lack of success was behind them becoming shells.

Nine of the companies are involved in the health sector and, in addition, the majority of the businesses that invests in are health and pharma-related. In fact, the AIM flotation of , one of its investments, was the main driver behind the rise in the Amphion share price.

The resources sector has been out of favour, but there were still eight companies involved in the sector in the list - six mining and two oil and gas.

, Best of the Best, , , , , , , and are the only companies in the 36 that have risen by more over a five year period than over one year.

Many of the 36 companies are still highly risky and a disappointing piece of news could easily send the share price into a dive. Many have also become more reasonably rated with less chance of significant upside in the near future. Even so, there are still good investment opportunities. Here are the five most attractive investments on the list.

Five share tips

The acquisitive business

Trakm8 (TRAK)

Telematics services and equipment provider Trakm8 has a carefully targeted acquisition strategy. The purchase of BOX Telematics two years ago provided a step up in scale and Trakm8 is investing in expanding BOX's manufacturing capacity. In its latest deal, Trakm8 is paying £3.3 million for DCS Systems, which designs camera systems for the automotive sector. This camera technology can be integrated with Trakm8's telematics technology. DCS will be included for nine months in the year to March 2016 and house broker finnCap has upgraded its 2015-16 earnings forecast from 9.1p a share to 10.3p a share. Net debt will be around £3 million after the acquisition, but Trakm8 is cash generative. Trakm8 shares are trading on 17 times prospective 2015-16 earnings, but continued strong growth in profit should rapidly reduce this multiple.

The former shell

OptiBiotix Health (OPTI)

OptiBiotix Health is one of my AIM tips of the year so it is unsurprising that the human microbiome-based health products developer is one of the picks. OptiBiotix is using naturally occurring bacteria in the human gut to develop treatments for lifestyle ailments, such as obesity, diabetes and high cholesterol. The strategy is to develop food ingredients and supplements because they can become commercial products in a relatively short time.

A multinational company has already entered into an option over a potential cholesterol reducing product that is being trialled. OptiBiotix has also entered an alliance with fellow AIM company Venture Life, which provides manufacturing and distribution expertise. The first products could be launched next year. Helium Rising Stars Fund has reduced its stake to below 3%. That has been achieved without hampering the share price - helped by the positive news flow. There are no fundamentals to keep up the share price, but OptiBiotix has shown its ability to deliver decent progress without overhyping itself. The announcement of a commercial product in one of its main areas should trigger a further jump in the share price.

The recovery play

STM Group (STM)

has had a rocky time on AIM and the share price is still below the 50p a share placing price back in 2007. Originally focused on setting up offshore trustee companies and other offshore services, Gibraltar-based STM's recovery has come from its investment in the higher margin pensions business. It took time to build this business up but it is making a significant contribution. Additional intermediaries are being taken on and offices in the Middle East and Asia being set up.

There was uncertainty about what would happen with the company's outstanding convertibles but more were bought back and fewer shares were issued than expected thereby reducing potential dilution. The shares are trading on 11 times prospective 2015 earnings, falling to nine in 2016. There is even a chance that STM could start paying dividends again.

The long distance runner

Solid State (SOLI)

Batteries and electronic products supplier Solid State has been on AIM for 19 years and it has a solid record over that period. Carefully chosen acquisitions have added to the organic growth. The growth had already gained momentum in recent years, but a three-year Ministry of Justice (MOJ) contract to supply offender monitoring tags and equipment has taken it to a new level. This contract is worth £34 million and could be extended. In the six months to September 2014, revenues grew 39% to £17.1 million, while pre-tax profit jumped 175% to £1.55 million. This is before the MOJ contract has kicked in. A profit of £5.27 million is forecast for 2015-16 when there will be a full contribution. The shares are trading on 15 times prospective 2015-16 earnings and a forecast yield of 2.3%. That is still attractive.

The revitalised company

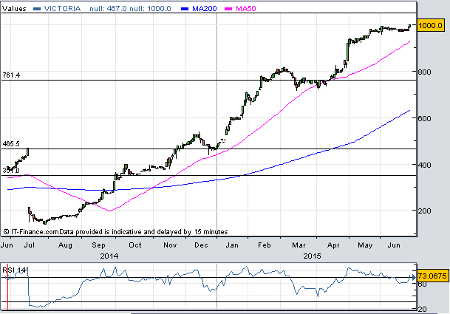

Victoria (VCP)

Carpets and floorcoverings supplier Victoria is a company that has been quoted for decades, but has been on AIM for a couple of years. The move to AIM enabled the new management team to restructure the business. A 292p a share special dividend was paid nearly one year ago. Victoria acquired rival Abingdon for £7.65 million in September 2014, with potential deferred consideration of up to £4.5 million - based on the next three years of operating profit. Whitestone Weavers, which designs and supplies carpets made by third parties, was acquired earlier this year and this provides an opportunity for Victoria's yarn and manufacturing operations. These acquisitions have taken Victoria's annualised revenues to £200 million. Victoria has already said that its figures for the year to March 2015, which will be reported in July, were ahead of expectations.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.