Share of the week: Telecom Plus triumphs

26th June 2015 16:53

by Harriet Mann from interactive investor

Share on

A set of record results despite serious industry challenges has injected some much-needed market confidence into . It was enough to send the shares storming to the top of the FTSE 350 this week. Headwinds aren't set to abate just yet, but the year ahead looks promising and the utility group still has a tempting 5% dividend yield.

Of course, falling energy prices, milder weather and aggressive promotions from industry newbies weren't helpful. In fact, chairman Charles Wigoder reckons it's the worst they have seen. But the group still managed to generate record sales and profits, with double-digit growth taking revenue to £729.2 million and adjusted pre-tax profit to £52.2 million. At £52.5 million, debt was better than expected and earnings per share rallied to 53p, which, along with strong cash generation, allowed bosses to inflate the dividend payout to 40p per share.

The low-cost supplier of gas, electricity, telephony and broadband is clearly doing something right. Not only were total customer numbers up 11% at 581,513, but customer quality also improved with Double Gold Members - buyers of all five services - accounting for nearly 28% of new members, up from 21% last year. This has improved again to over 29% since the period end. But absolute growth in the mid-single digits is behind Telecom's target and this isn't likely to improve while there is a gap between lower introductory deals and higher established domestic household tariffs. Another round of price reductions at major energy suppliers in the summer should trigger what Telecom reckons will be a 12 month process to diminish this gap.

The group has its one million customer threshold firmly within its sights, which will represent 4% of the market. A Competition and Markets Authority (CMA) review into aggressive discounting practices should support performance. With its competitive cost base, unique multi-utility offering and hopes to expand into the insurance market, management still expect profits to reach between £54-58 million this financial year and want to pay out a 46p per share dividend. However, management have warned that they no longer see straight-line growth potential, expecting it to fluctuate between strong and challenging trading periods.

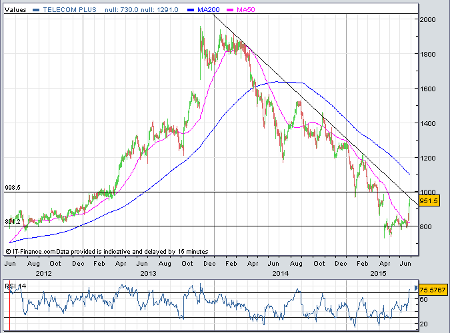

Ending Friday at 953p, Telecom's market capitalisation surged 16% to £764 million this week. The shares are now kissing the downward trend line after bouncing off recent technical support (see chart, click to enlarge). But there are still significant resistance levels the shares must overcome to revisit 12-month highs; firstly the 1,000p ceiling and then its 200-moving day average.

The shares are currently trading on 17 times Peel Hunt's 2016 earnings forecasts and with a prospective dividend yield of 4.8%, which should support the stock in the medium-term against price and regulation uncertainty, in lieu of potential re-rating catalysts.

Peel Hunt's Charles Hall reckons the shares are worth 1,000p, while finnCap analyst Andrew Darley has a more bullish price target of 1,310p in mind. Darley said:

Prospects remain strong, albeit nearer-term uncertainty remains, exacerbated by short sellers. We expect that the next utility price cuts will draw a line underneath the temporary growth slowdown, which is included in forecasts. Regulatory pressure on competitors should contract with TEP's continuing aim to be "whiter than white", regarding pricing and initial discounts.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.