FTSE 100: Buyers take charge

2nd July 2015 12:30

by Lee Wild from interactive investor

Share on

A four-day sell-off which cost over 320 points, or 4.7%, ended abruptly Wednesday. An 88-point rally was surprising, coming as it did after polls showed a majority of Greeks will vote "no" to Europe in Sunday's referendum. Markets across Europe are holding their ground Thursday, too, ahead of today's US jobs data, but it's the reaction to Greece which is causing much head-scratching.

"[It] can mean one of two things," speculates Deutsche Bank strategist Jim Reid. "Firstly, that markets were encouraged that the yes vote had some momentum after the banks were closed despite being behind, or secondly that a no vote will not actually bring too much market turmoil if it materialises. If there is a hint of the latter then yesterday's early trading reaction could be seen as a big positive."

And the Greek polls reveal Sunday's vote will be closer than prime minister Alexis Tsipras would have us believe. The most recent poll - by GPO for BNP Paribas bank - had the "Yes" campaign on 47.1% and the anti-EU vote on 43.2%.

Experts also doubt Greece will give up EU membership. A Barclays survey revealed 66% of respondents to its quick poll believe the referendum results will favour a "Yes" vote. "If that were the outcome, European equities are thought to be the asset class with most attractive risk reward," says the broker. "In the case of a 'No' vote, the worst risk reward is to be found in peripheral debt."

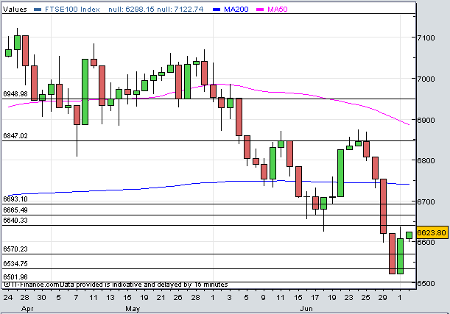

(click to enlarge)

Of course, today's US non-farm payrolls report - reported a day earlier than normal due to Friday's Independence Day break - is keeping money on the sidelines. Consensus is for a 230,000 gain in June, although Barclays predicts 250,000.

Taking a look at the charts, Trends & Targets analyst and regular Interactive Investor contributor, Alistair Strang, has run the numbers. Here are the levels to watch today.

"Below 6,570 points at 6,535 with secondary at 6,501," says Alistair. "And if 6,416 fails, it must bounce from 6,280 unless they start introducing gaps downward at the open. The FTSE needs better 6,640 to permit growth to 6,665 with secondary 6,693."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.