Mapping FTSE 100 rally to 8,200

7th July 2015 12:01

by Lee Wild from interactive investor

Share on

Greece is bust, China is in freefall, and rates are about to rise both here and in the US. Key markets are flashing 'sell' signals, too. It doesn't sound like a recipe for a rally. But the eternal optimists at Citi think global equities still look attractive compared to expensive fixed income markets. In fact, they believe share prices will go much higher, exceeding current consensus.

"We think that this bull market is ageing but not finished," writes Citi. "Previous mature bulls have been associated with rising credit spreads, higher volatility and equity bubbles. They traditionally turn into bear markets when the profit cycle peaks, which does not look imminent."

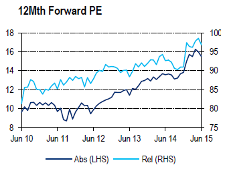

Currently, global equities trade on 19 times trailing earnings per share (EPS), and while "no longer cheap" - the historic median is 17 times - the current cyclically adjusted price/earnings (P/E) ratio (CAPE) of 22 times "still looks attractive" at a discount to the long run median of 24 times.

Citi also reckons the cut in consensus earnings forecasts for 2015 has been overdone. Down from 11% estimated growth to just 4%, consensus is now stabilising and its strategy team pencil in 9% growth in developed market EPS this year. That implies potential for upgrades outside the energy sector.

(click to enlarge)

"We expect the MSCI ACWI [All Country World Index] global benchmark to rise 17% over the next 12 months in local currency terms," says Citi. "This implies a mild rerating."

QE-stimulated Japan and mainland Europe are Citi's favourites. "Greek concerns may weigh on European equity markets but we think that ECB policy will limit contagion and would buy into any summer setback."

But what about the UK?

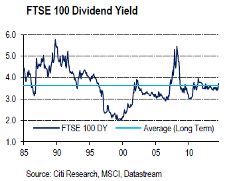

Clearly, Citi thinks this is no bar to share price growth. "UK equities look neither cheap nor expensive on most absolute valuation measures. UK equities continue to look very cheap relative to other asset classes," writes analyst Jonathan Stubbs.

"Our end-2015E FTSE 100 target of 7,700 needs a combination of dividend growth, modest re-rating and reduced macro risks relating to Greece," says Stubbs. But by this time next year, the broker pencils in an uber-bullish 8,200 for the , a 26% return on current levels. Heading this rally will be materials, consumer discretionary and financials, while consumer staples and utilities are best avoided.

Of course, it could all go wrong. "Our pro-QE stance on Eurozone equities would be threatened by widespread contagion from Greece," admits Stubbs. "An upturn in the Fed fund cycle and associated strong US$ could put pressure on economies with current account deficits. The ongoing China slowdown threatens commodity-related economies and companies."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.