Insider: It's definitely selling season

17th July 2015 13:31

by Lee Wild from interactive investor

Share on

Greece has avoided bankruptcy by the skin of its teeth, and despite the likelihood that it will meet few, if any, of the tough financial targets set out by European negotiators, stockmarkets have rallied. The FTSE All-Share is up over 5% since last week, but that's been the cue for company directors to trouser some profits while the going is good.

Office space provider plunged during the financial crisis, but is up tenfold since 2009. The share price has risen 60% since October and the firm recently followed up knockout full-year results with a bullish first-quarter update.

Finance chief Graham Clemett has seen enough. In the role for eight years now, the number cruncher and Julia Clemett have sold 70,000 shares at 944.76p, netting over £660,000. Their remaining 101,736 shares are currently worth a cool £1 million.

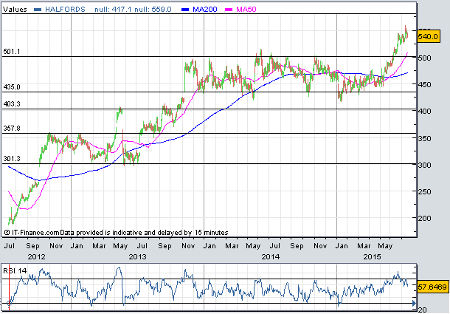

has had a cracking run, too (see chart below). Its shares are up threefold since 2012 and 22% in the past three months to near-record highs, driven most recently by consensus-beating full-year results. Finance boss Andrew Findlay waited until after this week's reassuring first-quarter report to flog his last 35,709 shares at 540.6p.

But this is a forced sale as Findlay leaves the company in October after accepting the top bean counters job at budget airline easyJet. The £193,000 raised will help pay for a new house following his relocation later this year from Halfords' Redditch HQ to nerve centre at Luton Airport.

(click to enlarge)

Last week, we reported that John Fitzgerald, group managing director at London-focused housebuilder was selling up. The reason we were told was "personal financial commitments". Unfortunately, we now hear that it's part of a divorce settlement.

Fitzgerald sold again this week - 100,000 shares at 421.375p and 25,000 at 416.5p. This half-a-million pounds is the final share sale linked to the break-up, says high-flying Telford. Fitzgerald currently owns 107,718 shares and 33,000 share options.

Elsewhere this week, Barrie Clark at also has reason to cash in stock. Chairman Clark retires at the end of this month after 18 years at the IT services firm's top table. The £142,500 netted from the sale of 285,000 shares at 50p should help pay the bills. His remaining 206,000 shares are worth £109,000, but broker finnCap thinks they'll be worth 80p one day given rapid growth forecasts for this year and next.

And Alan Foy at raked in a tidy £3.5 million after selling 1.1 million shares in the company which owns, operates and maintains metering systems and databases for energy companies. Chief executive Foy got 315.5p for each share, a 17-month low (see chart below). But don't feel too sorry for him. His remaining 7.8 million shares, or 9% of the company, are worth a whopping £26 million.

(click to enlarge)

And finally, a buy order. High street newsagent is worth five times more than it was in 2009, but the wife of chairman Henry Staunton is bothered. And two days after spending £320,000 on 20,000 shares at 1,598p, the price hit a record high at 1,635p.

Investors who took our cue to buy late last year at little more than a tenner would have been quids in. The share price bounced off technical support at 1,000p and kept going. Then, last month, with the price at 1,600p, we asked again whether the shares were still good value.

Buy on the dips was our conclusion, and broker Investec Securities tips the shares up to 1,700p given forecasts for double-digit profit growth for at least the next three years.