Rights issues possible for these oil strugglers

24th July 2015 13:58

by Lee Wild from interactive investor

Share on

Last summer's crash in oil prices has been a welcome boost for consumers, but the impact on the oil industry has been profound. Companies have cut jobs and slashed both discretionary spending and capital expenditure in a bid to protect profits. It's a theme that will dominate the upcoming results season. But there's only so much you can strip out, and alternative action is inevitable. That, say some, may mean huge cash calls to adjust debt-heavy businesses to a world of cheap oil.

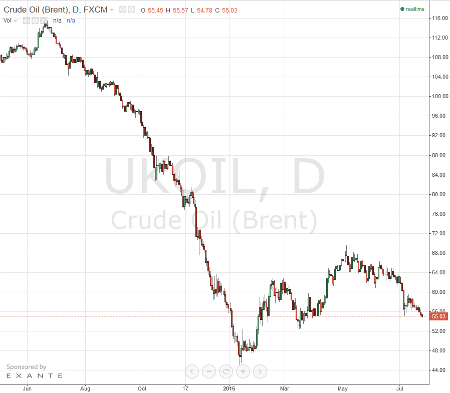

In June 2014, Brent crude was selling for over $115 a barrel. However, a sharp increase in supply as Saudi Arabia chose to protect market share wiped 61% off the price in just four months. A partial recovery from the $45 low to near $70 has begun to unwind, and Brent is back below $55 for the first time since early April.

Operational measures taken are all well and good, but current debt-weighted capital structures are the result of investment decisions made when oil was trading around $100 a barrel.

"We believe this elephant needs to be addressed before indebted producers/developers can convince investors that they have an investment proposition which can thrive in an environment where oil price expectations are pegged at ~$60-70/bbl," writes the oil team at Barclays.

Source: TradingView

Capital structures have shifted away from their optimal levels - defined as net debt to core asset value - argues the broker, with debt levels way above what would be viewed as comfortable at these prices. "We recognise that the suggested solutions are not painless or simple - issuing equity, creating/realising value from pre-development assets, reducing expenditure - but we believe they may be preferable to a prolonged period of gradual adjustment with increased stock price volatility, a higher cost of capital and less growth potential."

Companies covered by Barclays - (underweight, 45p price target), Lundin Petroleum (equal-weight, SEK135), (overweight, 250p) and (overweight, 550p) - are put under the microscope in a 25-page note. But the analysis and solutions should be equally applicable to several other indebted exploration and production companies.

But what can management do to remedy the situation?

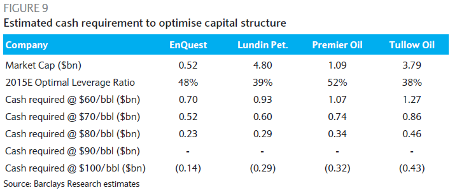

"The impact of lower oil prices is company specific, but we believe a shift to a $70/bbl outlook is sufficient to raise questions in all four cases," says Barclays. To quickly achieve an optimal capital structure for a $70/bbl oil price outlook, it calculates the combined cash requirement for EnQuest, Lundin Petroleum, Premier Oil and Tullow Oil at a whopping $2.7 billion.

Currently, the four have a combined market capitalisation of $10.2 billion and net debt of $8.6 billion at the end of 2014.

"Proposing equity issuance remains taboo; particularly while stocks trade at or near multi-year lows and investors remain on the sidelines of a sector that is a discretionary investment for many," according to Barclays. "Nevertheless, we believe new equity could form part of the solution in tandem with other measures. In particular, we believe deal structures aimed at expanding the core asset portfolio without adding more debt and finding commercial solutions for pre-development assets can play an important role."

The mechanics of the issue are actually quite straightforward. Cheap oil means assets are worth less, and with company debt unchanged, equity investors are left to absorb the full effect of the lower oil price outlook on asset valuations.

Numerical example of how a sub-optimal capital structure can occur

The optimal capital structure for a portfolio was determined as a 50:50 debt to equity split. A decline in the oil price outlook reduces the value of the asset base by 25%. The level of net debt is unchanged, leaving equity to absorb the change in asset value - the 25% fall in asset value therefore drives a 50% (25%/50%) decline in the valuation of the equity.

The capital structure under the revised oil price outlook becomes 67:33 (50%/(1-25%)) debt to equity, leaving the asset base supporting a higher level of financial leverage than was deemed optimal.

The alternatives

Resetting the capital structure from a $90 outlook to a $70 outlook would require EnQuest to raise about 100% of its current market cap, while Premier would need to raise 67%, according to Barclays.

It's hard to see management giving the green light to that kind of cash call, especially given limited appetite for large-scale cash equity raises right now. However, issuing equity to buy production or development assets on the cheap may be more palatable.

Tullow is also well-placed to offload pre-development assets for cash, thereby reducing net debt. Alternatively, all four could try the "patient self-help approach", although Barclays warns that this may result in the sub-optimal capital structure getting worse before it starts to improve.

"With the exception of Premier Oil, we forecast that the ratios of net debt to core asset value are set to increase next year in a $60/bbl, $70/bbl or even $80/bbl oil price outlook. These increases in leverage may be reasonable if a company was already operating at or close to its optimal capital structure, if operational progress could support more debt (the optimal capital structure can increase over time). Patience combined with one/some of the pro-active measures already outlined could enable Premier Oil to reset its capital structure over the next 12-18 months."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.