Bombed out AIM stocks to buy now

24th July 2015 15:36

by Andrew Hore from interactive investor

Share on

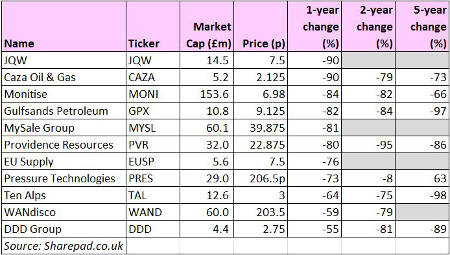

Having last month written about the top performers on AIM that have at least doubled over the past year, this time I am assessing the poor performers over the same period. The focus is the AIM companies that could do much better in the coming year.

The share prices of the majority of FTSE AIM All Share companies that have been quoted for at least one year have declined over the period. Some of these have fallen by a small percentage but there are plenty that have halved.

Here are four companies whose share prices have at least halved, but that have potential to recover some of those losses or possibly do even better. These are not short-term investments and the companies need to do more work, and in some cases wait for their markets to recover before there is a substantial recovery. There are varying chances, though, that any or all of them could continue to fail.

Ten Alps (TAL)

3p (-63.9%)

One of the most significant things about is the backing of its institutional shareholders which have lent money as well as buying new shares in order to provide finance to keep the TV programme producer and publisher going. Herald Investment Trust and other institutional investors obviously realised that Ten Alps could be nursed back to a sound financial position.

Ten Alps anticipated that there would be a move from paper publications to the digital equivalent and it acquired a business-to-business (B2B) publishing firm in order to move its publications online. The switch to digital was not smooth and Ten Alps took on a lot of debt when it made this and other acquisitions. The government terminated the profitable Teachers TV contract in 2010 when the business information market was being hit by a decline in advertising revenues. A debt restructuring and fundraising was undertaken at the end of 2010 and further fundraisings were subsequently required. The appointment of former ITN boss Mark Wood as chief executive at the end of 2014 and the reverse takeover of Reef Television could prove the turning point for the group.

Reef provides additional expertise in daytime and factual entertainment TV formats, including Selling Houses with Amanda Lamb, as well as providing additional scale and a larger programming catalogue. Reef also has in-house post-production facilities. The enlarged group will produce 150 hours of TV each year. Ten Alps is paying an initial £2 million in cash, loan notes worth £1.5 million and deferred consideration of up to £1.5 million plus additional earn-out payments if total gross profit over three years exceeds £6 million. In 2014, Reef made a gross profit of £1.49 million on revenues of £5.74 million.

Ten Alps has also consolidated every ten shares into one new share. A placing and subscription at 2p a share (post-consolidation) raised £4.5 million. Some of the existing debt will be consolidated. The shares issued in the latest acquisition and refinancing account for more than 90% of the enlarged share capital.

Entrepreneur Luke Johnson, who is a former chairman of Channel 4, is joining the Ten Alps board. The strategy is to grow the TV division, build on the strong B2B publishing market position and increase revenues from providing digital content. Ten Alps continues to be loss-making, but the reduced cost base and the latest acquisition mean that it is in a good position to return to profit.

Pressure Technologies (PRES)

206.5p (-73.1%)

is a good, sound business, but the fall in the share price might lead you to think otherwise. The problem is that the oil and gas sector is a major customer for the company's high pressure cylinders. The order book has fallen by one-third since the end of September 2014 due to a sharp reduction in capital spending by oil companies.

This meant that Pressure Technologies swung into loss in the six months ended March 2015, although if exceptional write-offs are excluded the company is still profitable. Cash generation from operations was strong, but Pressure moved into a net debt position because of acquisitions and the purchase of a freehold that will lead to annual cost savings of £200,000.

(click to enlarge)

Despite the uncertainty about the oil and gas sector and the slow build up in demand from the biogas sector, the long-term outlook is positive. Pressure Technologies is involved in specialist engineering businesses where there are a limited number of suppliers and it has a strong market position. Demand will eventually recover and Pressure Technologies will be there to take advantage.

An underlying 2014-15 profit of £2.7 million is forecast but there has already been a number of downgrades over the past year. This figure does appear achievable and the unchanged interim dividend of 2.8p a share suggests that management is confident that it can maintain the full-year payout.

This is the least risky of the four companies. There is undoubtedly an underlying demand for Pressure Technologies' products and this will return when the markets improve. On top of this there is a solid balance sheet even if there is net debt after recent acquisitions.

DDD (DDD)

2.75p (-54.9%)

3D software developer has been on AIM for more than a decade and it took many years to make a profit. However, just when it seemed that its time had come the fashion for 3D proved to have a limited life. DDD fell back into loss in 2013 after two years of profit. The 3D products are still generating revenues, but management made the decision to move into 2D software. The investment in these new software products should start to pay off in the next year or so.

TriDef SmartCam, which can be used to replace the background image when people are on webcams, is the first of the new products to be launched. For example, if someone is on a webcam playing a game with other people they can use this software to change their background to one that fits with the game. A two-year distribution agreement has been secured with SplitMedia Labs, which runs XSplit live internet broadcasting services. SplitMedia will integrate the software with its own products. XSplit users can acquire TriDef SmartCam for $9.99, with DDD getting 70% of the payment. There are more deals and other new software to come.

(click to enlarge)

While the performance of the underlying business should improve there are also potential one-off gains from enforcing the company's patents and getting compensation from firms that have been using the technology without paying royalties. Management has signed up patent adviser Dominion Harbor, which has expertise in negotiating these payments and it does not always have to resort to legal action. There will be a 70/30 split of any royalty and other payments between DDD and Dominion Harbor. DDD also has tax losses that might be available to use if gains are made. A suit has just been filed against LG Electronics alleging the Korean firm's range of 3D televisions infringe three of DDD's US patents.

DDD directors have been snapping up shares in recent weeks. Chairman Nicholas Brigstocke acquired one million shares at 2.125p a share, taking his stake to 1.8%, while Dr Sanji Arisawa bought 500,000 shares at 3p each, which took his shareholding to 1.5%.

DDD's long-term prospects are dependent on the success of its new software products with the potential of one-off shareholder distributions if major patent infringement cases are successful.

EU Supply (EUSP)

7.5p (-76.4%)

Sweden-based is a company that should benefit from EU mandates that mean government-related tenders have to be managed electronically by 2018. EU Supply has its own platform that provides SaaS-based sourcing tendering and contract management services for the European public sector. The platform can be configured online for different national requirements.

The e-tendering market is forecast to grow from €75 million in 2013 to €350 million in 2017 and EU Supply addresses one-third of this market. There are plans to partner with an IT services company to move into new markets.

EU Supply joined AIM on 13 November 2013 when it raised £5 million at 22.6p a share. The share price almost doubled in the first six months as a quoted company. The problem has been that, even though EU Supply has won contracts, the growth in the business has not been fast enough to cover the ramp up in costs in anticipation of growth.

EU Supply is losing money and is unlikely to move into profit until 2017. A profit of £1.5 million forecast for 2017 would put the shares on a multiple of just over four times EPS estimates. But forecasts have been consistently downgraded so this has to be viewed with caution. The attraction of EU Supply is that it does have customers and it can grow revenues from this customer base.

(click to enlarge)

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.