Five shares to play low-risk theme

29th July 2015 09:34

Macro factors are affecting market volatility like never before, mostly due to credit spreads and 10-year bonds. And with oil prices plummeting to six-month lows, now is the time to minimise exposure to macro events, urges Citigroup. Instead, the broker proposes an alternative and names the five key shares to play the theme.

All the chat across equity markets these past five years or so has been around the avoidance of risk, and low risk strategies have outperformed - check out the popularity of low volatility and income funds.

Citi believes some forms of risk is more acceptable than others, and that after 10 years of high correlation the low macro risk strategy will continue to decouple from a more vanilla low risk approach - low risk is down 2.3% year-to-date, while low macro risk is up 2.3%. "We see this theme continuing and the market moving more towards rewarding micro over macro, particularly as we head into earnings season," it says.

"We advocate a greater emphasis on micro and look to do so by holding stocks with the highest proportion of idiosyncratic risk - i.e. stocks with the lowest macro risk [stock specific risk]."

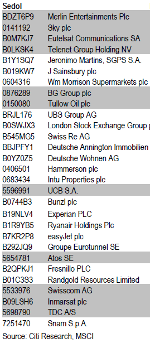

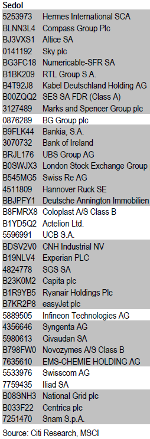

Two screens from Citi's latest low macro risk portfolio identify stocks in each sector that have the highest relative levels of idiosyncratic risk. They are all rated 'buy' at Citi and have a market cap of at least $10 billion.

We've included the two lists below, but Citi singles out five star stocks on its "focus list" - , , Swisscom, and .

Latest Citi Buy Rated Low Macro Risk / High Idiosyncratic Risk Opportunities, MSCI Europe

Large Cap Low Macro Risk / High Idiosyncratic Risk Opportunities, MSCI Europe

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks