Lloyds shareholders set for massive windfall

3rd August 2015 13:10

by Lee Wild from interactive investor

Share on

half-year results may have been mixed, but the high street lender still has an army of fans in the City. Two of them have just upgraded forecasts for 2015 and one thinks the bank could return as much as £25 billion to shareholders over the next three years.

Second-quarter numbers were largely positive, with a sharp drop in impairments meaning underlying pre-tax profit of £2.2 billion beat consensus estimates by 13%. A £1.4 billion charge for payment protection insurance (PPI) mis-selling was "disappointing" though, and the CET1 ratio - a key measure of balance sheet strength - missed forecasts.

But, on the day that the UK government sold its stake in Lloyds down below 14%, JP Morgan says it believes the bank's capital generation exceeds upcoming pressures from risk-weighted assets (RWA) harmonisation and conduct. It also upgrades adjusted pre-tax profit forecasts by 3% for this year to £8.75 billion. Of course, the chancellor's post-Summer Budget tax grab means EPS cuts for the following two years.

"With the shares trading at 9.1x P/E vs European banks sector at 10.5x P/E FY17E and 1.4x P/TNAV for 14.9% RoNAV 16E, we remain overweight," the broker says, repeating its 105p price target.

Coincidentally, that's also what the team at Barclays reckons Lloyds shares will be worth.

"Lloyds shares currently trade at a 1.5x 2015E tangible book multiple. While this may appropriately reflect the returns that the company can generate, we do not believe that it factors in the extent of capital return that we expect over the coming years," says analyst Rohith Chandra-Rajan.

And the return could be substantial. "We continue to see the prospect of capital return and the final exit of the UK government as the main catalysts for share price outperformance from Lloyds over the next 12 months."

(click to enlarge)

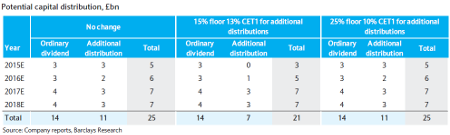

Barclays expects Lloyds to be significantly capital accretive with the current 13.3% common equity tier 1 ratio (CET1) ratio forecast to rise above 14% this year and to near 18% in 2018.

"We forecast £14 billion of dividends being paid out to 2018 with capacity to return an additional £7-11 billion of capital to shareholders through share buybacks or special dividends," adds Chandra-Rajan. "That’s a total of £21-25 billion of capital that could be returned, or 35-40% of the company's current market capitalisation."

That works out at 30-35p a share, with about 20p in ordinary dividends and the rest through additional capital distributions. "We shouldn’t have to wait long to see this policy implemented."

Just what shareholders receive could depend on potential changes to risk weightings, particularly in the mortgage book. This, says Barclays, could ultimately result in mortgage RWA floors implemented at somewhere between 15% and 25% (see below).

(click to enlarge)

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.