Forecast-beating Pendragon remains bullish

4th August 2015 13:32

by Lee Wild from interactive investor

Share on

Car dealers have profited since the financial crash from a combination of government help, cheap financing and economic recovery. Low interest rates mean drivers have more to spend on new motors, which explains why £600 million has just beaten expectations again.

After stripping out profit from the disposal of car dealerships and a £13.8 million windfall from a property deal, Pendragon made a pre-tax profit of £40.3 million. That's up 23% on 2014 and means profit has doubled in just three years.

"The group has had an encouraging start to the year and our anticipated outturn for the full year is comfortably ahead of expectations," said chief executive Trevor Finn who runs both the Evans Halshaw and upmarket Stratstone dealerships.

Revenue rose 10.7% in the six months ended 30 June to £2.3 billion, or 13.4% on a like-for-like basis. Used car sales grew by 11.8%, new cars by 16.5% and aftersales 5% like-for-like, and gross profit was up across the board. And proceeds from the disposal of a 6% stake in King Arthur Property for £23.8 million helped halve net debt to £53.1 million.

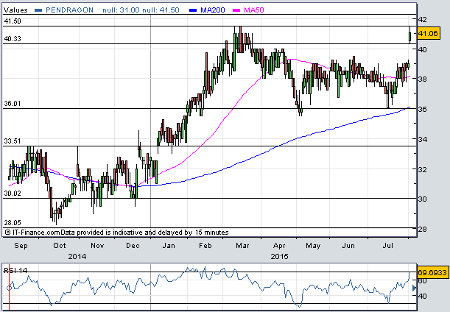

(click to enlarge)

And the boom in new car sales will have an inevitable benefit on higher margin aftersales like servicing, maintenance and repair.

"The last four years of growth in new car sales will drive favourable market conditions in our aftersales and used car sectors for the medium term and we expect the new car market to be stable," said Pendragon on Tuesday.

Pendragon shares were worth just 7p at the end of 2011. Now, they're nudging a six-year high at 41.5p. It's the third time since March they've hit that level and the shares have largely stuck to a 36-41.5p range for the past six months.

This is clearly an encouraging set of results, and Pendragon has proved adept at exceeding market expectations - it spent much of last year telling us 2014 profit would beat estimates. They did, and this year appears to be going much the same way, but it will need further catalysts to break out of this trading range and establish new support above 41.5p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.