Aggressive summer portfolio doubles profit

7th August 2015 16:28

by Lee Wild from interactive investor

Share on

Summer is typically more pedestrian in terms of share price performance. However, after extensive research, Interactive Investor has uncovered two seasonal portfolios which have significantly outperformed the wider market over the summer months for the past decade.

Like our hugely successful Winter Portfolios, the summer version is incredibly simple. All it requires is that investors buy a portfolio of stocks on Friday 1 May and sell it on Friday 30 October. The beauty of this portfolio is that investors are guided by both a defined entry and an exit point, which takes the stress out of trying to time the market.

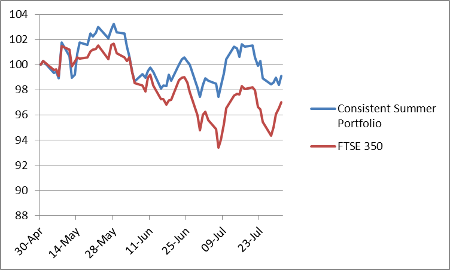

As before, we teamed up again with Harriman House, publisher of The UK Stock Market Almanac, to create two model portfolios. First, we screened the FTSE 350 for those stocks which had delivered the most positive annual returns over the entire previous 10 years. The result is Interactive Investor's Consistent Summer Portfolio - our Summer Smoothie - which has averaged annual growth of 8.9% since 2005. The FTSE 350 benchmark index is up an average of just 0.3%.

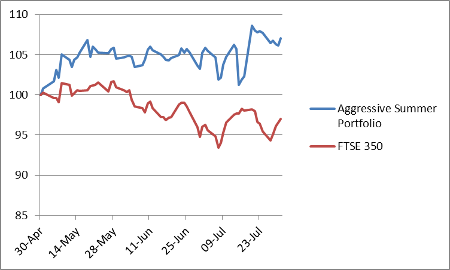

Fine-tuning the data to include companies with a minimum of eight years as a FTSE 350 company, and which still generated positive annual returns 70% of the time, generated even bigger potential profits. With greater potential reward comes extra risk, hence the naming of our Aggressive Summer Portfolio - the Summer Sizzler. It has outperformed the benchmark index every year for the past decade, this time by an average of 17%

Here's a round-up of the highlights and lowlights from the third month of this six-month strategy.

Market round-up

We have reached the halfway stage of our latest seasonal trading strategy and things are still looking good for both summer portfolios. It was a real rollercoaster month for the benchmark FTSE 350 index, with a Greek referendum rejecting tough bailout conditions, only for prime minister Alexis Tspiras to then agree an equally tough deal with European lenders. It was rubber-stamped by Greek politicians, and the story may have slipped from the business pages, but it's not the end of this sorry tale.

China has been in the news, too, and mining stocks yo-yoed in tune with the data. A further slump in the Shanghai Composite index also caused panic over here, although the overheated domestic stockmarket appears to have stabilised, at least for now.

A four-day rally at the end of July left the FTSE 350 up 2.4% on the month, slightly better than the Consistent Summer Portfolio, but still behind over the three months. However, our Aggressive Summer Portfolio blew them both away.

Aggressive Summer Portfolio

(click to enlarge)

All five stocks in the Aggressive Summer Portfolio were in the thick of it last month. We had three risers - , , and - and two fallers - and . And it was Aveva that stole the show and was largely responsible for the 3.6% jump in this basket of shares, doubling the three-month gain to 7%.

A bid from French giant Schneider Electric had the British engineering software designer up 22% in July, although the complicated nature of the deal makes valuation tricky. It's officially a reverse takeover, with Aveva buying Schneider's industrial software assets and the French firm paying Aveva £550 million, which means a potential windfall for Aveva shareholders. Analysts think the shares might be worth 2,600p.

And there was a strong initial response to full-year results from software supplier Micro Focus International. While both sales and profit were largely in line with consensus estimates, there's interest in the potential for substantial shareholder returns. Investec thinks there's potential for total cash return of £682 million over three years, equating to about 23% of the market cap. The broker upgrades its price target from 1,240p to 1,600p.

BTG continues to divide opinion, but the pharma group had a good first quarter, and the controlled launch of varicose vein treatment Varithena in the US continues. JP Morgan thinks the shares, currently trading on 19 times earnings estimates for the year to March 2017, are worth 1,100p. Even stripping out Varithena still generates embedded valued of 880p, says the broker.

On the downside, activist hedge-fund Marwyn Value Investors has sold part of its substantial stake in successful Peppa Pig firm Entertainment One at a substantial discount to the market price. It wiped out 11% of the share's value, but appears to remain committed to its remaining stake and eOne now looks cheap. Soapmaker PZ Cussons also ran into trouble. Full-year results crept past consensus estimates, but Nigeria is a risky place to do business and some believe that is not yet reflected in the share price.

Consistent Summer Portfolio

(click to enlarge)

It was a mixed month for the Consistent Summer Portfolio, too. stole the show with an 11.5% rally despite missing second-quarter earnings forecasts. Sales of ADHD drug Intuniv suffered and Shire splashed cash on new products. But the shares had been on an upward trend already and chief executive Flemming Ornskov was in bullish mood. Launching a hostile $30 billion all-share bid for America's will guarantee an interesting August.

In a typically volatile month for , the power transmission network company ended 4% higher. Its Future Energy Scenarios paper was published mid-month, but the share price improvement was largely in line with the wider stockmarket rather than anything to do with its outlook for the UK energy market for the next 20 years.

Spirits giant staggered lower after the US Securities and Exchange Commission (SEC) launched an investigation into allegation it shipped excess inventory to distributors in an attempt to artificially boost sales figures. Full-year results a few days later reflected a tough year for Diageo - organic sales growth was flat on volumes down 1%. However, Barclays still thinks the shares are worth an extra £4 each and believes they "can gently outperform from here".

Elsewhere, , the pet pharmaceuticals firm, traded flat on the month. Annual revenue rose by 10% at constant exchange rates, or 5% on a reported basis, despite a drop in antibiotic sales. The weak euro is an issue, too, although hopes are high for Dechra's pipeline.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.