Halfords plunges after August washout

2nd September 2015 11:34

by Lee Wild from interactive investor

Share on

Typically awful British summer weather has sent sales of bikes at crashing during the past eight weeks, and the firm has warned that second-quarter cycling sales will miss expectations. The car parts chain said the rain had deterred the casual cyclist, but also blamed heavy discounting by rivals and tough comparatives with last year. Halfords shares slumped by over 9% in response, yet management still think full-year results will match consensus estimates and plans for the cycling business will be unveiled at November's interim results.

Like-for-like cycling sales sank by 11% between 4 July and 28 August compared with a 2% increase in the first quarter. This time last year they were up over 11%. That dragged group retail sales down by 1.3% during the period. Still, it is lower margin stuff, and the bike repair business grew by 27.6%. A new range of Star Wars and Frozen-themed kid's bikes and accessories will be in the shops in time for Christmas, too.

Chief executive Jill McDonald, who took over from -bound Matt Davies less than four months ago, remains confident about the long-term growth opportunities in cycling - more of that in November - and points out that both car maintenance - up 7.3% - and the car stereo and alloy wheels unit - up 4.7% - offset weakness elsewhere.

"Trading in all other areas of Halfords Retail remains strong and in line with, or above, expectations, particularly car maintenance where parts was a standout performer," says the company. "Customer service metrics continue to improve. Actions in Autocentres continue to drive profitable growth."

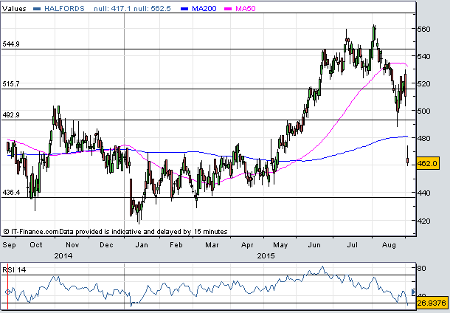

(click to enlarge)

It also reckons retail gross margin will be "at the better end" of previous guidance for a full-year reduction of 25-75 basis points, and retail operating cost growth of about 3%, down from 4-5% previously. "Through mix benefits in margin and prudent cost control in line with the first half, management anticipates full-year group profit before tax to be broadly in line with prevailing market consensus," said Halfords.

Investec Securities analyst Kate Calvert now predicts a 3.5% drop in half-year pre-tax profit to £47.7 million, and tips Halfords to make £84.7 million over the 12 months, up 4.4%. That's slightly less than consensus estimates for £86.6 million. "While Q2 cycling was disappointing, we see good future growth opportunities here and across the offer," writes Calvert who sticks with her 580p price target and 'buy' rating. "Strong surplus cash generation (c£40m pa. post capex, tax & div) & a virtually debt free business in FY17e increases the likelihood of a capital return too."

At 462p, Halfords shares trade on 13.5 times earnings per share (EPS) estimates for the year ending March 2016, a discount to the general retail sector. True, they've crashed through the 200-day moving average and enthusiasm for the shares may take time to return given current market conditions. However, modernisation at Halfords has further to run, earnings are tipped to grow in the high single-digits for at least the next three years, and the shares look temporarily oversold, according to the relative strength index (see chart).

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.