Why FTSE 100 could fall 500 points

3rd September 2015 11:39

by Lee Wild from interactive investor

Share on

Down 200 points one day, up over 100 the next; the severity of the recent sell-off means the will likely continue to swing wildly through the subsequent consolidation phase. Shutting local stockmarkets as it celebrates the end of World War II at least removes China as a potential banana skin for a couple of days, but the US could spring a surprise Friday and oil prices are all over the place.

We'll get a good idea of whether the Federal Reserve will raise interest rates on 17 September when monthly jobs data is published tomorrow. According to Deutsche Bank strategist Jim Reid it's "one of the most eagerly anticipated FOMC meetings in a decade". Look for non-farm payrolls of 170,000, he says, lower than Wall Street estimates of 217,000. However, even if the Fed does raise rates this month for the first in nine years, a second is thought unlikely until deep into 2016.

Today's European Central Bank (ECB) meeting could be interesting, too. ECB president Mario Draghi may be forced to admit further action will be required to get inflation back on track toward 2%. "This could eventually include extending the duration or increasing the monthly target of asset purchases," says Deutsche.

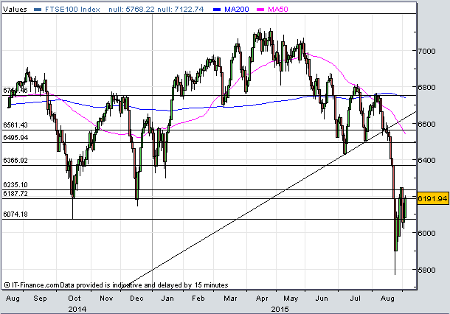

(click to enlarge)

Predictably, miners feature heavily among Thursday's winners. , , and are all up between 3% and 5% mid-morning. In fact, only and are in the red. However, the FTSE 100 - up 1.8% Thursday at 6,191 - remains stuck below a key level which means a possible plunge to below 5,700 remains a possibility.

"Despite the FTSE being up 1.4% and 3% yesterday, the gains seem illusory and as the market is trading below a long term uptrend and failing to cancel the drop potentials to the 5,600 level, extreme caution is advised," says Alistair Strang, a technical analyst at Trends & Targets and friend of Interactive Investor.

"When going through stocks, an uncomfortable number have triggered severe drops and are failing to produce any contrary indications. On the basis 'if it ain't going up, it's going down', the FTSE needs better 6,235 to cancel our expectation of the 5,600's. Additionally, it needs better 6,658 for us to believe growth is once again occurring."

There is a potential trade here, Alistair adds. "A few ballsy traders will go short at 6,230 with an extremely tight stop. It’s a potential 600 point trade with very little risk." This one, however, is no dead-cert. "Sometimes they work out but I don’t think this one will," Alistair tells us. "The market lacks the ‘we’re all doomed’ feel."

Alistair's price points have a great track record, but even he admits to worrying about missing an important signal. And his concern is understandable. Trying to guess the impact of a sharper-than-expected slowdown in China is nigh on impossible. Official growth figures are widely believed to be inaccurate and somewhat optimistic. We'll only really know what's happening when companies begin reporting numbers over the next few months.

Italian luxury label Salvatore Ferragamo said last week that it had not seen a major difference in recent trading to the previous two quarters. "Typically the most sensitive trading comes from wholesale as third party destocking takes hold, and this has been seen in Swiss Watch Export data," point out analysts at Barclays. We'll get a further steer from Richemont, among the luxury brands most exposed to the Chinese consumer, on 16 September.

Whatever the eventual outcome, the likelihood of another big market move remains. Says Strang: "We're paid to be paranoid but historically, when we've enjoyed a phase of feeling clueless, it generally presages a sharp change of market direction."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.