10 of the best high-yield growth shares

9th September 2015 14:41

Ben Hobson from Stockopedia

Investors with a knowledge of stockmarket folklore will doubtless be aware that this week marks the start of the St Leger Festival at Doncaster racecourse. The old adage to "sell in May and go away, stay away till St Leger Day", is a myth that academics have now largely debunked. But like so many age-old sayings, it's hard to categorically deny that there isn't a glimmer of truth in it.

This year selling up for the summer would have helped to avoid a sharp 12% decline in the value of the . But despite the stomach-churning market volatility during this period, some investment strategies were remarkably resilient. One of them was an approach that targets growth companies with high dividend yields.

Combining growth and income

On paper, growth and income aren't easy stablemates. Many growth stock investors want companies to reinvest cash so they can grow further and faster - rather than paying it out as dividends. But others see the combination as highly desirable.

Lord Lee, the Liberal Democrat peer and well known small company investor, looks specifically for growth shares that pay dividends. In his book, How to Make a Million - Slowly, he sets out his focus on just two yardsticks when investing in a company: dividend yields and low price-to-earnings ratios.

Crucially, Lord Lee sees the dividend as a key factor in driving the company's performance. He explains: “The payment of a dividend acts as a significant discipline on the Board of a PLC in that it has to find the cash, each year, to pay those dividends.”

A similar approach has been put to work by American share analyst Kevin Matras of Zacks Investment Research. His growth and income screening rules look for companies that analysts are rating as either 'strong buys', 'buys' or 'holds'.

The strategy also looks for "quality" criteria, such as above average return on equity (signalling that the company is good at generating cash); manageable levels of debt and a valuation (based on price-to-earnings) that's below average. Each company's beta (or the volatility of its share price) also has to be low. Finally, the shares must be on above average dividend yields.

Using these growth and income rules, Stockopedia screened the market for Interactive Investor.

| Name | Market Cap £m | % 3m EPS Upgrade (for the next financial year) | Return on Equity % | PE Rolling (1 year) | Dividend Yield % |

| Air Partner | 45.6 | 7.17 | 21.6 | 13.9 | 5.05 |

| Tullett Prebon | 911.7 | 0.28 | 24.7 | 10.6 | 4.5 |

| Produce Investments | 44.5 | 1.39 | 12.6 | 5.95 | 4.16 |

| Mitie | 1,057 | 0.33 | 9.02 | 11.1 | 4.02 |

| Fairpoint | 77.8 | 8.06 | 6.82 | 8.91 | 3.75 |

| Alumasc | 60.8 | 1.69 | 32.5 | 8.76 | 3.52 |

| NWF | 75.9 | 0.42 | 18.3 | 11.7 | 3.44 |

| Macfarlane | 61.1 | 1.95 | 17.9 | 10.5 | 3.43 |

| 32Red | 62.3 | 27.5 | 68.9 | 9.44 | 3.22 |

| H&T | 73.7 | 1.89 | 5.33 | 11.8 | 3.1 |

The results are dominated by small-cap stocks with the exception of outsourcing group and inter-dealer broker . Based on dividend yield, charter airline company tops the group with a yield of just over 5%. Produce Investments, a potato farming business, has the lowest price-to-earnings ratio at 6 times. Meanwhile, online casino and sports betting operator boasts both the highest earnings upgrades over the past three months (EPS forecasts have been hiked by 27.5%) and the highest return on equity, at 68.9%.

Making up the rest of the list is consumer finance business , engineering products firm , animal feeds and fuel oil distributor , packaging company and high street pawnbroker .

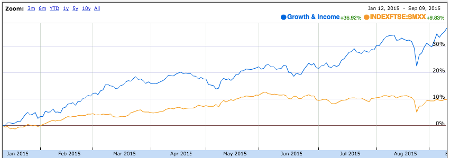

So far this year, this portfolio of shares would have delivered a 36.9% return versus 9.8% from the FTSE SmallCap XIT index. But remember, your own detailed research is always essential.

(click to enlarge)

Small cap growth stocks bounce back

This year, sticking with the old adage to ‘sell in May’ might have avoided choppy market conditions, but many share prices have quickly bounced back. Interestingly, smaller company indices have been resilient and some strategies that target small-caps have fared well. Growth companies and dividend income are two of the most popular investment areas among private investors. Combining those factors has proved to be a remarkably robust approach in the current conditions.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson of Stockopedia.com, the rules-based stockmarket investing website. You can click here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a two week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

● To learn more about Ben Graham and his deep value investing strategies, you can download the FREE Stockopedia book, How to Make Money in Value Stocks.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

About the author

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks