Amur could halve costs at Siberia mine

17th September 2015 10:04

by Lee Wild from interactive investor

Share on

In the past year, shares in have risen from just a few pence to 44p and back down to 13p. Wild swings are not uncommon at Amur, although the spike in May following approval from the Russians for its project in eastern Siberia was exceptional.

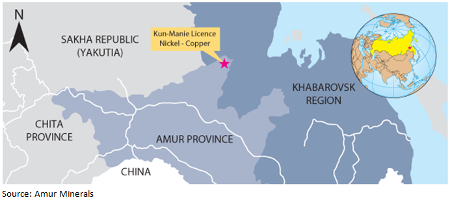

Focus is now very much on getting the mine at Kun-Manie, one of world's largest nickel copper sulphide plays, into production. Chief executive Robin Young was kind enough to bring us up to speed over a coffee this week.

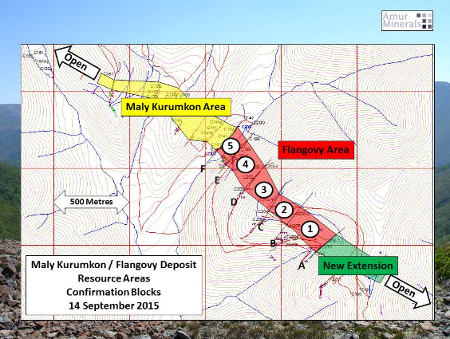

Currently, Amur is racing to complete its 2015 drill programme, which aims to have completed 6,000 metres of drilling at its Flangovy deposit before freezing weather in November halts work until June next year. That's mainly so-called infill drilling, whereby further holes are drilled to confirm the size of known high-grade zones.

"This could be a real game-changer in the operation of the mine. It opens up the chance of a combination of both underground and open pit mining," Young tells us. "We will have met all our drilling targets by November. We'll then have to wait six weeks to get the samples back from Moscow. After that we'll complete a revision of the Flangovy resource estimate."

(Click to enlarge)

And that's what this is about; upgrading speculative inferred resources to the more certain indicated category, which further de-risks the asset. And upgrades do seem likely. Results from 2,224 metres of drilling have been reported so far, confirming the presence of 32% of contained metal within the Flangovy resource. The average JORC grade within Block 1 is put at 0.6% nickel with an average drill intercept grade for all Block 1 holes near 0.8% nickel.

According to the company's broker SP Angel, grades at Block 1 at Flangovy come in 33% higher than currently included in the JORC resource model. "A potential improvement in planned processed grade should translate in better economics at the Kun-Manie project."

Progress is obviously encouraging, but this is a long-term project, and there is much still to be done. Doing business in Russia can be treacherous, but here at least Amur is currently in favour with politicians.

Russia normally limits foreign ownership in these type of projects to less than 25%. Amur owns 100% of the rights at Kun-Manie as it's a strategic deposit. Russia is desperate for investment in the far east of the country where unemployment is high and infrastructure poor – it's just opened its first casino there.

And President Vladimir Putin is willing to back economic support for the region through a number of agencies and incentive programmes. Amur has already held talks with the state-backed Far East and Baikal Region Development Fund, which will help identify sources of funding when the time arrives, possibly in the Russian and Chinese capital markets.

"A real earnest effort is being made by the Russian government to make sure large scale projects like ours go forward," says Young.

And projects like this do not come cheap. The cost of getting the project to production is currently put at $1.4 billion (£903.6 million) which assumes an even split in production between underground and open pit. But there is a real chance that these cost estimates could change, and Young says he'll have to have a closer look at the numbers.

Costs could halve

That $1.4 billion includes $300 million earmarked for road improvements, but there is a real possibility that the Russian state could pay for that. Amur also wants to develop its own smelter which, if it goes for the bells and whistles option producing a refined product, would cost an estimated $600 million. A scaled-down operation would set it back just $150 million, slashing the potential bill for Kun-Manie to a far more modest $650 million.

All the engineering work on site should be done within the next 18-24 months, Young says, after which Amur will be in a position to carry out a bankable feasibility study (BFS). That will cost money, although Young says he already has a "good chunk" of the cash.

Amur can then seriously engage financial institutions regarding funding for the project. A trio of European banks, Russian lenders or Russian sovereign wealth fund seem the most likely to bankroll the venture.

But might Amur be tempted into a joint venture or alternative deal with a third party?

"We're not waiting for anyone," says Young. "We're fully committed to go the full distance, but understand that at some point someone else will want to get involved."

Of course, miners like Amur are always ready to do business, and Young admits he'd consider proposals as they arise. "But we'll only do deals which benefit shareholders."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.