Trusts to reduce your equity exposure without foregoing income

18th September 2015 14:17

by Fiona Hamilton from interactive investor

Share on

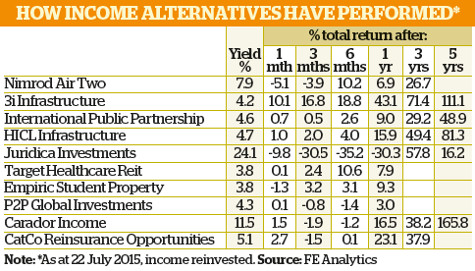

Institutional investors have been steadily reducing their exposure to equities, so as to reduce their vulnerability to the eventual end of the bull market. With many stockmarkets looking expensive and increasingly volatile, individual investors should consider doing the same.

This need not mean a diminution in returns, however, even in the short term, as the ever-wider range of alternative investments on offer means investors are no longer forced to retreat into bonds or cash.

Real estate, private equity and hedge funds are the alternatives most favoured by the largest sovereign wealth funds, pension funds and wealth managers, and all three are available to even the smallest investor via trusts and closed-ended funds; but so too are an increasing array of newer options.

Lower charges, higher yields

Many of these newer alternatives have lower charges than private equity, and a lower correlation with equities - which is important if you are seeking shelter from a bear market.

Alternative asset classes with virtually no correlation to equities include asset leasing, litigation specialists and reinsurance. Most of the trusts invested in them are also more transparent than hedge funds, which have no yield and proved much less resilient than expected in the 2008 crash.

And many have higher yields than the better-established and more conventional property trusts. However, it is important to remember that higher yields generally imply either higher risks or lower growth prospects, as those who bought into split capital income shares discovered to their cost in the early noughties.

The three Doric Nimrod funds led the way on the asset leasing front, raising funds to invest in Airbus 380-861 aircraft and leasing them to Emirates Airlines, initially for 12 years.

Shares in all three trusts are priced to yield around 8% paid quarterly, but note that there is no income growth, and no real growth potential until the planes are sold - when the price realised could be undermined by difficulties for Airbus, political instability in the UAE, or an unexpected fall in air travel.

All seem unlikely, but then so did the severe slump in the oil price, which has seriously damaged demand for the vessels that expected to charter to the offshore oil and gas industry.

Coming off a premium

, a litigation trust that finances corporate claims in the US and UK in return for a cut of the proceeds, ramped up its distributions over the past three years to give a yield of 22%.

However, the recent loss of $29.7 million (£19 million) on a single court case lopped around 10% off its net asset value (NAV) per share and seems likely to have an impact on the distribution. This loss may prove a one-off, but it has wiped out the trust's premium rating.

Reinsurance involves providing retro-insurance (reinsuring the insurers) for property losses arising from major catastrophes.

The sector has been attracting a lot of new money, which has exerted downward pressure on rates, but - the older and larger of the two specialist trusts - says its underwriting capacity for 2015 has been deployed at rates in excess of target returns.

On that basis, and barring a spate of claims, it should achieve its objective of double-digit annual returns and an annual distribution equal to Libor plus 5% of NAV.

Insurance is a notoriously risky business, but CatCo seeks to protect shareholders from a major setback by excluding terrorism and spreading its exposure across a wide range of geographies and sectors.

It also matches its maximum exposure to each potential loss with funds lodged with Bank of New York Mellon. It proved its resilience in 2011, when the NAV held up well despite the Japanese tsunami and multiple earthquakes in New Zealand.

Buy debt and residential

Investors seeking a less difficult to understand option might prefer one of the many debt funds to have emerged in the past five years, in many cases capitalising on the shortage of bank funding.

The highest three-year returns have been achieved by funds specialising in collateralised loan obligations, such as dollar-denominated and Tetragon Financial.

Those wanting something a lot less complex might prefer newer arrivals such as or , both of which have attracted a lot of new money this year.

Managed by the respected TwentyFour Asset Management group, UK Mortgages invests in good-quality UK residential mortgages, an asset class that has proved impressively resilient in past economic downturns. It targets returns of seven to 10% a year, most of which will be paid out in quarterly dividends.

Lastly, investors should not overlook the attractions of specialist property trusts such as or . The latter specialises in UK care homes and offers a yield of 5.7%. Unlike some other healthcare property funds, its dividend is fully covered, and its shares trade on a relatively modest premium.

Leases on its nursing homes are usually long term, with upward-only or RPI-linked rent reviews; and the manager expects demand to stay strong.

Social infrastructure for security and diversity

Infrastructure offers an attractive, partially inflation-linked yield and a low correlation with equities, and has become a well-established alternative with institutional investors.

Social infrastructure involves investing in contracts to finance facilities such as schools, hospitals, roads, law courts and sewers, typically over 15 to 30 years and usually on an availability rather than a usage basis. If the contracts are in the UK, payments are effectively underwritten by the UK government.

Retail investors have been able to join in since the first specialist infrastructure funds were launched in 2006. Their resilience was demonstrated in 2008, when their share prices dipped but their NAVs did not. With seven social infrastructure trusts now available, yields are typically around 5% and dividend growth is 2 to 2.5%.

Average NAV returns have been well ahead of the FTSE All-Share index over one year, but are a little behind over three.

One problem for the social infrastructure funds is that their public-private partnership and private finance initiative contracts will have no value when they terminate. They try to counter this by raising new money to invest in additional contracts, but it has become much harder to do so on good terms due to fierce competition from institutional investors.

This is encouraging the funds to increase their overseas exposure, which introduces foreign exchange risk, as funds such as have demonstrated recently.

Another problem is that the funds' NAVs are calculated on a discounted cash flow basis, which is favourable when interest rates are falling but not when rates rise. It is therefore no surprise that premiums across the sector have come off quite sharply this year.

Stand-out performers

HICL and (3IN) have been the stand-out performers in the social infrastructure sector. The former looks the more reassuring safe haven, due to its well-diversified portfolio and predominantly UK focus.

3IN is very different in that it has sizeable overseas exposure including India, and invests in companies involved in infrastructure provision, notably transport and utilities. This can be very rewarding, as demonstrated by the recent sale of 3IN's stake in the Eversholt train leasing company.

It also means 3IN's holdings have indefinite revenue streams, in contrast to the limited life of the Pficoncessions. But while that enhances their long-term potential, it also makes them more vulnerable to stock market gyrations.

Added to which, 3IN is uncomfortably concentrated, with four companies accounting for over three quarters of its portfolio.

The past two years have seen the launch of six renewable infrastructure funds with similar structures to the social infrastructure funds, but focusing mainly on wind and solar power generation.

Their shares trade at lower premiums than those of the social infrastructure funds and this boosts their yields, which average 6% paid quarterly.

However, there are several good reasons for their lower ratings. One is that around half the income of the renewable infrastructure funds comes from selling the power they generate, so it can be affected both by climatic influences on the amount generated and by changing power prices.

Another is their vulnerability to political pressure, as evidenced by the unexpected removal of the climate change levy announced in the July Budget, and the energy secretary's moves to limit subsidies on new investments in various forms of renewable generation.

Hopefully the government will not totally undermine the sector by reneging on the terms of existing installations.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.