Why Glencore shares could be worthless

28th September 2015 13:10

by Lee Wild from interactive investor

Share on

has big problems. Having built up a staggering $30 billion of debt, commodity prices have plunged and a recovery looks a long way off. In fact, a lethal cocktail of excess supply and weak demand means commodity markets could remain subdued "for several years", according to one expert. Even if prices fall no further, they believe that "nearly all" the equity value of Glencore could "evaporate". Little wonder the miner's share price collapsed by over a quarter to 70p Monday.

"In the current climate, debt is fast becoming the most important consideration for mining company management," explains Hunter Hillcoat, an analyst at Investec Securities. "If confidence wanes in the ability of highly indebted companies to refinance principal payments, a major crisis can suddenly be precipitated.

"It was concern on precisely this issue that we believe forced Glencore to act recently, with a package of measures including cutting near term dividends, raising $2.5 billion in equity and committing to $2 billion of asset sales."

With the price of copper, iron ore and coal tipped to continue falling, a hit to profits is inevitable - Goldman Sachs expects Glencore will make a pre-tax profit of $1.3 billion in 2015, down from over $4.9 billion last year.

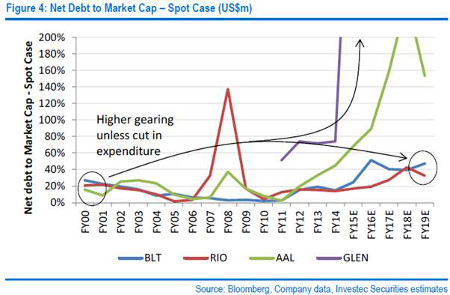

That means the proportion of earnings consumed by debt service - both interest and repayments - is compounded. Gearing ratios have risen to 18% and 25% for and respectively, with Anglo American at 70% and Glencore at over 300%.

In an extreme case (see chart below), without better metal prices, net debt would constitute almost half of the hypothetical equity value of Rio Tinto and BHP Billiton, based on a forward price/earnings (PE) multiple of 15. For Glencore it's much worse.

"For Glencore and , greatly diminished earnings under a spot scenario [where prices do not recover] would leave the two companies with almost no equity value under our PE based methodology, given that gearing levels would literally be off the chart," writes Hillcoat.

"Despite the drastic action that management has announced recently (even assuming all of the measures are successfully implemented), a spot price scenario results in an almost complete collapse in forward earnings such that no meaningful estimate of shareholder value can be derived under our PE methodology. In effect, debt becomes 100% of [enterprise value] and the company is solely working to repay debt obligations."

And having just raised £1.6 billion ($2.5 billion) from a share placing with institutions and management at 125p, Goldman Sachs has also raised concerns and slashed its price target.

If the broker's estimates for commodities prices and FX rates are right, Glencore's investment grade (IG) rating would be secure in the medium term. If not, the company is in trouble.

"When we run the same analysis using spot commodity prices and spot FX rates, most of Glencore's credit metrics would be at the border of required ranges to maintain its IG rating," writes Goldman. "A 5% drop in spot commodity and flat FX would see most of Glencore's credit rating metrics fall well outside the required range to maintain its IG rating, suggesting concerns would quickly resurface."

Goldman has cut its 12-month price target for Glencore from 170p to 130p.

But a look at the tea leaves suggests this may be way too optimistic. Alistair Strang, technical analyst at Trends & Targets and regular Interactive Investor contributor, reckons the charts reveal an absolute bottom at 37p, although it could be even lower.

"Should Glencore actually close a session below 97p, it's going to need a bit of a miracle as there's clear air between such a point and 37p," says Strang.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.