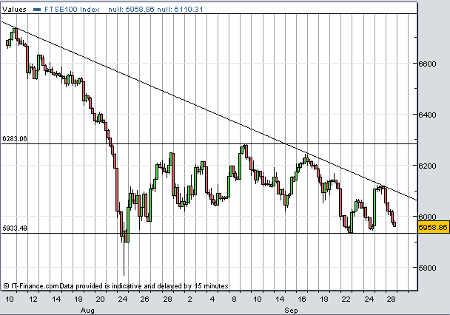

Where will FTSE 100 find support?

28th September 2015 17:30

by Lee Wild from interactive investor

Share on

It seems like we've been here before. One glance at the chart below reveals we have. A spectacular rally quickly followed by a ruthless sell-off has been an all-too-familiar theme since the correction last month. And pretty much every plunge has been led by the heavyweight miners. This time is no different.

is stealing the show for all the wrong reasons. Both Investec and Goldman Sachs have stuck the boot in, warning that if commodity prices do not improve - and there's a good chance they won't - Glencore shares could be worthless. "In effect, debt becomes 100% of [enterprise value] and the company is solely working to repay debt obligations," warns Investec.

Having floated in 2011 at 530p, Glencore shares fell as much as 28% to 66.7p Monday. That leaves major institutions and management who took part in this month's £1.6 billion placing nursing huge losses.

Over 1.3 billion shares were placed at 125p each. Chief executive Ivan Glasenberg snapped up 110.1 million, Daniel Mate 42.2 million and Telis Mistakidis 41.4 million. The trio are currently down over £106 million in less than a fortnight. As expected, , , and are being sold aggressively.

Emerging market concerns have and under the cosh, too. Standard is heading toward credit crunch lows at breakneck speed and HSBC shares are near their worst in four years.

Further selling on Wall Street following a lacklustre finish Friday had the FTSE 100 on the backfoot through the afternoon session. In fact, the blue chip index finished down 150 points at 5,958, its low for the day and not far from levels last seen in the dark days of the August correction.

(click to enlarge)

It's clear that only modest earnings growth here cannot justify current valuations, despite the recent de-rating, and the threat of a hard landing for the Chinese economy is more than enough to keep traders selling into any rallies. With the next US Federal Reserve meeting still a month away, and a stream of disappointing data out of China - profits at industrial companies fell 8.8% in August, a record low - these themes are likely to continue.

Remember, too, that October has gained a reputation - perhaps unfairly - for a high probability of stockmarket disasters - think 1929 and 1987. In truth, September has been a worse month over the years, but clearly the omens for this October are not great.

We've asked our technical analyst friends at Trends and Targets what they think, and it ain't pretty. "Normal rules suggest the FTSE is now heading to 5,884 with secondary 5,840. Or maybe even 5,675. Only if above 6,120 does this become improbable," writes chartist Alistair Strang.

This is not over.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.