15 shares to buy on the cheap

29th September 2015 10:51

by Harriet Mann from interactive investor

Share on

As the third quarter draws to a close and with share prices at multi-month lows, investors might be tempted to pick up some bargains. Analysts at Barclays have been burning the midnight oil once again and have come up with a host of ideas. They've identified 52 top stocks with average upside potential of 36%.

A mix of poor sentiment, driven by emerging market weakness, concerns about China and US interest rates, and a deteriorating outlook for global growth, have a crucial element of the recent bear run, which has seen the lose 12% since mid-August.

On average, Barclays' favourite 52 companies have a market cap of $34.9 billion and a historical return on equity of 18.8%. With the average forward price/earnings (PE) multiple of 17.8 times in line with the longer-term average, the key to stock picking is GDP growth and lower oil prices.

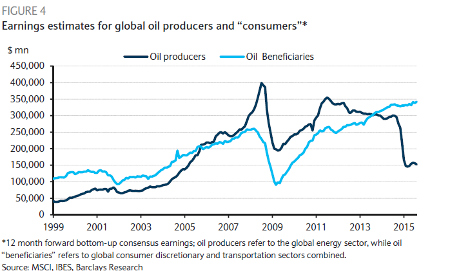

Barclays reckons GDP growth will hit 2.6% in 2016, so positive equity returns of 8.4% should be on the cards. After slashing oil major's earnings forecasts by around $148 billion, but raising consumer sector guidance by only $9 billion, there is potential for an "oil dividend", it says.

"If our earnings projections are right, today's extremely negative sentiment towards equities should unwind, with global equities able to recover the bulk of their recent losses over time," said the analysts. "History suggests adopting a contrarian perspective when sentiment is this extreme."

With the market failing to price in a European recovery but monetary growth expanding, Barclays' biggest overweight view is on Continental Europe. US equities are less attractive, with the region losing its growth advantage.

Here, we profile Barclays' top 15 stocks listed on the London Stock Exchange.

Glencore 106.3p

'Overweight' - price target 186p

shares crashed by as much as 27% on Monday after Investec warned that if depressed commodity prices remain, an increasing chunk of its declining earnings will be needed to pay off its debt pile - which is now more than its market value. But Barclays' overweight stance on the diversified miner is underpinned by the assumption that base metals will "gently" rise over the next few years.

"This delivers very strong earnings growth driven by volumes, most of which is coming at very attractive capital intensities, impressive cost reduction and intriguing supply/demand fundamentals over the next two to three years in a number of the company's principal commodity exposures - in particular copper, zinc and nickel," said Barclays.

The analysts like its lack of iron ore exposure and reckon accelerating its growth projects will drive profitability over the next couple of years, improving cash flow and creating one of the strongest EPS growth profiles. However, they admit that worsening base metals will could value the miner at just 63p.

"The company is trading on attractive medium-term earnings multiples on our price deck, which assumes rising base metals prices over the next couple of years: 2015-16E PEs of 15.8x and 13.6x, respectively," they explain. "This reflects the market's concerns around the balance sheet and the company's ability to retain its credit rating."

Royal Dutch Shell (A shares) 1,536p

'Overweight' TP 2,850p

acquisition of is expected to boost the oil major's free cash flow profile in most oil price environments, including lows of around $60 a barrel. The explorer's exposure to LNG and deepwater Brazil is also attractive.

"With the commitment of the management team to the dividend in both 2015 and 2016 - implying a 7.6% yield and the potential for further share repurchases in 2017, we see the shares as compelling value in the current environment," said the analysts. "Royal Dutch Shell is our Top Pick with 86% potential upside to our 2,850p price target."

On Monday, the group axed its Artic drilling campaign after finding one of its wells dry.

Ophir Energy 82p

'Overweight' TP 160p

Accounting for nearly half of its tangible net asset value (NAV), investment case depends on the commerciality of its Fortuna FLNG project in Equatorial Guinea. Although management have made progress establishing the concept, investors have got impatient and the shares have fallen by two-thirds over the last year.

"We believe this pessimistic viewpoint presents an attractive opportunity while Ophir aims to partially monetise its 80% stake in the asset ahead of project sanction in mid-2016."

Petrofac 763p

'Overweight' TP 1,400p

With an impressive backlog build-up, is on track to deliver impressive earnings growth from 2016-2017, especially with its high exposure to National Oil Companies.

With two divisions - Engineering & Construction and its development business (IES) - Petrofac's IES arm struggled in 2014 and is now being side-lined by management. IES is worth around $1 billion versus Petrofac's $1.8 billion total.

"Ex-IES the company should grow strongly in 2016F and 2017F, execution excepting, with the core business delivering, on our numbers, 91p/share of earnings," said the analysts. "This places the core business on just 6.3x PE, despite the business having significant embedded growth already in backlog, new contract potential and it trading on an average PE of c.15x over the 2007-14 period."

Schroders 2,790p

'Overweight' TP 3,785p

Thanks to its strong multi-asset offering, good fund performance and improving equity flow, is Barclays' top pick. As margin pressures increase domestically, it's useful for Schroders that over 60% of Schroder's revenues are generated outside of the UK. Inflow at the asset manager has been strong, with the higher-margin intermediary division averaging 6% annualised flow rate in the first half.

With a management team uncharacteristically bullish, a significant institutional pipeline and 77% of its assets under management outperforming the three-year benchmark, the future looks bright.

"We highlight that 13.9x headline 2016E PE (or ~11.9x adjusted for £1 billion excess cash) does not look stretched vs. a sector average of 12.5x and is at a discount to the through-the-cycle average of 17x," explained Barclays. "We believe the shares are good value for ~10% three-year EPS CAGR. We value SDR at a premium to the sector, reflecting our increased confidence around positive flow outlook, ability to protect revenue margins and good cost discipline."

Wolseley 4,114p

'Overweight' TP 4,700p

As a top pick in the European Business Services, Barclays reckons there is a multi-year opportunity for the distributer of plumbing and heating products to gain market share across the US. management currently reckons US markets will grow by between 4-6% with margins remaining strong and a healthy acquisition pipeline.

Investors should monitor ongoing share gains in the established business, expansion in end markets and regional growth across the US to drive outperformance there.

"These initiatives would further consolidate its leading position. In our base case, we believe the business will deliver 11% 2015-18 EPS CAGR, a 2.3% 2015E dividend yield and c.4% from capital returns/bolt-on acquisitions," said the group. "A valuation of 16x CY2016E P/E screens well across the sector for this level of growth."

Trading on 17 times forward earnings - falling to 15x in 2016 - Barclays reckons this is attractive for the business with average annual EPS growth of 11% from 2015 -2018.

IAG 567p

'Overweight' TP 750p

With flying towards "a new level of profitability", Barclays reckons cost and revenue improvements at the owner of British Airways will help beat its mid-cycle margin targets.

"We see this driving through-the-cycle cash generation, sustaining a regular dividend - something which IAG's constituent airlines failed to deliver in past cycles."

IAG leads the pack in two ways; firstly, it has exposure to rapidly consolidating markets, and, secondly, has an impressive restructuring track record. Its 9.4x 12 month forward PE is in line with its two-year average.

Melrose Industries 259p

'Overweight' TP 315p

Engineering turnaround specialist still looks undervalued, even after an increase in market value since its proposed disposal of Elster to Honeywell. While things are open to change, Barclays believes in the management team's proven approach to realise value, which remains a huge positive given their hunt for another acquisition.

"At the current share price of 259p we estimate that Brush is valued at c.£300 million. This is for a business which we currently estimate will generate EBITA of c.£45 million in FY15E, vs. £73 million in FY13A. Both Honeywell and Melrose management believe there should be no major anti-trust issues (although this is out of their control)."

Redrow 460p

'Overweight' TP 568p

Housebuilder is breaking the mould by maintaining investment in future growth, which will be rewarded if the cycle has a lot further to run, as Barclays believes it does. Although the group's fortunes are certainly tied to economic growth, the group is trading on an attractive PE ratio with scope to grow its dividend over the longer term.

Ashtead 944p

'Overweight' TP 1,375p

Sentiment towards servicing companies has soured in the declining oil and gas market, but many reckon fears are overdone after strong progress in recent first-quarter results.

"With a cyclical recovery in non-residential construction really only beginning in the second half of 2014, we believe the growth outlook is positive for a number of years," writes Barclays.

Greenfield openings and bolt-on acquisitions are holding back certain metrics at the moment for , but as these stores mature, the analysts see a lot of margin potential.

"We expect a reversal of the de-rating seen YTD; together with strong EBITDA growth, we expect this to deliver good share price performance," they add.

Savills 892p

'Overweight' TP 1,052p

With a highly sustainable operating profit margin, a diversified businesses and access to the growing US market, upmarket estate agent looks poised for outperformance despite obvious risks - threat of slowdown in London property market and economic weakness in Asia.

"Savills provides exposure to the increasingly global property advisory market. Its business model has an attractive mix of defensiveness and growth," enthuse the analysts. "It has a well-recognised brand name, a strong balance sheet and an opportunity to extend its presence in the US, mainland Europe and Asia Pacific."

WPP 1,330p

'Overweight' TP 1,670p

Replacing as Barclays' top pick in media, smashed expectations with its first-half results. Analysts are keeping an eye on slowing global growth and potential price pressure.

"We realise that investors usually pay lower multiples when the mix moves from revenues to costs, but we would argue that they have gone too far with WPP, which trading on 14.3x 15E PE is at a 5% discount to the market (STOXX600) and 15% below its 10% historical premium," said Barclays. "In our view, the company's strong track record (3.0% organic revenue and 11.8% EPS CAGR over the last 10 years) warrants a premium."

Dixons Carphone 408p

'Overweight' TP 530p

Investors do not appreciate the potential cost and revenue synergies the merger between Dixons and Carphone Warehouse can unlock, reckons Barclays, who earmark at least £40 million of savings by 2017. The bankruptcy of Phones 4U should support this year, too.

"We estimate a three-year EPS CAGR of 11%. On 13.4x FY16E PE we consider Dixons Carphone's risk/reward profile favourable."

TUI 1,178p

'Overweight' TP 1,360p

Believing offers an attractive entry point at all levels, Barclays' analysts celebrate the travel group's European exposure, cyclical upside, balance sheet optionality and margin potential. Its core business - tour operator, hotels and resorts, and cruise - makes up 94% of its group cash profit, and as a result of the merger with its German business; it has a better hold on its product, distribution and cash flow.

"We think TUI offers investors strong growth and a solid dividend yield (>4% 2016E). We forecast a FY15-18 EBITA CAGR of 14% and an EPS CAGR of 19%."

BT Group 404p

'Overweight' 600p

Ideally positioned to use M&A to drive sales growth, Barclays has pencilled in revenue growth of 1.5% and 3% EBITDA CAGR over the next five years at . The analysts are also optimistic of the group's ability to monetize data from its fibre and LTE investments (4G).

"The UK now has 20% higher EBITDA/pop vs. other key markets, whereas it was in line just four years ago. However, the combination of M&A, Fibreconomics and the ability to monetise data gives us confidence that this outperformance will continue for the next five years with 2.2% revenue CAGR for the UK market vs. c.1% elsewhere," the analysts concluded.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.