Summer portfolios streets ahead of the market

1st October 2015 17:30

by Lee Wild from interactive investor

Share on

After extensive research, Interactive Investor has uncovered two seasonal portfolios which have significantly outperformed the wider market over the summer months for the past decade.

Like our hugely successful Winter Portfolios, the summer version is incredibly simple. All it requires is that investors buy a portfolio of stocks on Friday 1 May and sell it on Friday 30 October. The beauty of this portfolio is that investors are guided by both a defined entry and an exit point, which takes the stress out of trying to time the market.

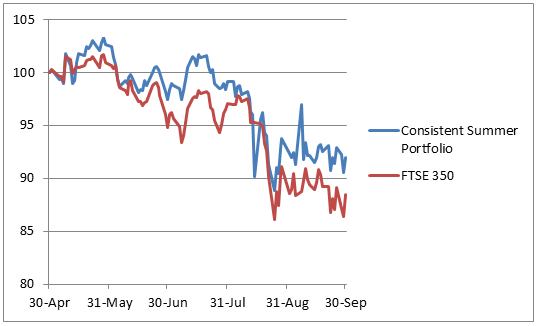

As before, we teamed up again with Harriman House, publisher of The UK Stock Market Almanac, to create two model portfolios. First, we screened the FTSE 350 for those stocks which had delivered the most positive annual returns over the entire previous 10 years. The result is Interactive Investor's Consistent Summer Portfolio - our Summer Smoothie - which has averaged annual growth of 8.9% since 2005. The FTSE 350 benchmark index is up an average of just 0.3%.

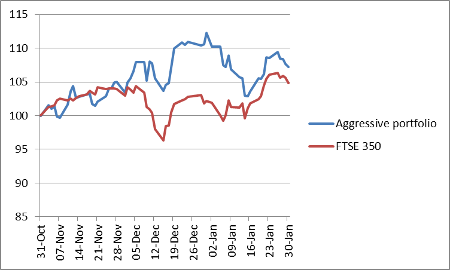

Fine-tuning the data to include companies with a minimum of eight years as a FTSE 350 company, and which still generated positive annual returns 70% of the time, generated even bigger potential profits. With greater potential reward comes extra risk, hence the naming of our Aggressive Summer Portfolio – the Summer Sizzler. It has outperformed the benchmark index every year for the past decade, this time by an average of 17%.

Here's a round-up of the highlights and lowlights from the fifth month of this six-month strategy.

Market round-up

Little did we know when we started the summer portfolio experiment in May that this would not be a typical summer for global equity markets. It's been anything but quiet, and, as suspected, the August crash has created havoc.

The widely-watched FTSE 100 traded a near-400-point range in September in a month peppered with huge gains followed by savage sell-offs, and vice-versa. The VIX index, a key measure of volatility, has remained above the 20 mark for most of the past six weeks, the longest stretch since January 2012.

Investors clung to every word from US Federal Reserve members, desperate to hear that US rates would rise in September. They didn't, and concerns about both the US and Chinese economies caused a fresh round of jitters. Commodity prices kept falling, and with them the companies that rely on the metals for profits. China continues to hold the key here.

And a massive shock from Volkswagen gave the market something else to worry about. Fitting a clever "cheat device" to fix emissions tests on diesel vehicles wiped billions off VW's valuation and hurt its legion of suppliers. Truth is, we still don't know how bad it will be.

Still, despite the toing and froing, our pair of summer portfolios suffered have less than the wider market over the five months. As we head into the historically stronger fourth quarter, both should excel if the market behaves.

Aggressive Summer Portfolio

September has a reputation as a tricky month for the stockmarket. And so it proved for our Aggressive Summer Portfolio which had an absolute shocker. Our basket of "summer sizzlers", which has smashed the wider market over the past 10 years, slumped by 7% during the month. It underperformed the FTSE 350 benchmark index - down a more modest 2.9% - too, and ended a month in negative territory for the first time since we created this seasonal portfolio. It is, however, down just 6.6% over the five months compared with the FTSE 350 which has lost almost 12% of its value.

takes most of the blame. The media group, which owns rights to the Peppa Pig kid's cartoon franchise, plunged by 17%, taking its five-month decline to 21%. A decision by hedge fund Marwyn Value Investors to flog its entire stake in the business was taken badly. And on the final day of the month, the company announced it was using a heavily-discounted rights issue to pay £140 million for another huge chunk of Peppa Pig firm Astley Baker Davies.

Soaps and detergents colossus nightmare continued. Business has been torpedoed by everything from Ebola to a slowdown in emerging markets to a weak Nigerian currency. Now, it says profit fell 5% in the year to May and, despite trading in line with expectations and receiving support from City brokers, investors bailed out and the shares fell 8%.

Elsewhere, engineering software designer - underpinned by a recent bid from French giant Schneider Electric – fell 6%, and software supplier 8%. Pharma group continues to divide opinion. This month it's up 3.5%.

Consistent Summer Portfolio

For a change, it was the Consistent Summer Portfolio which took the monthly honours. A decline of 2% must be considered a result given the carnage going on all around and that the FTSE 350 fell even further. Yes, the portfolio is down 8% over the five months, but it's still outperforming the benchmark index, which has slumped by almost 12%.

Irish drugmaker took a pasting despite winning a court battle in the US protecting its patent for hyperactivity drug Vyvanse. Analysts at Barclays were perplexed. They think the shares look cheap and believe they could be worth £57. Clearly, the company's pursuit of American rival Baxalta remains a distraction.

Apart from PZ Cussons, which also appears in the Aggressive portfolio, was the only other faller. It published full-year results which were largely in line with expectations, which likely kept buyers interested.

Elsewhere, gained a couple of percent over the month as the City warmed to the firm responsible for Smirnoff vodka and Bell's whisky. Eamonn Ferry at broker Exane BNP Paribas upgraded the shares to 'outperform' with 1,900p price target after the company said its first quarter had gone as expected.

stole the show, however, up nearly 7% as investors fled the madness for the relative sanity of a stock offering a 5% yield and a long history of dividend growth.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.