10 bargain shares to flourish

7th October 2015 12:45

by Ben Hobson from Stockopedia

Share on

How can you tell the difference between a company in terminal trouble and one that's on the cusp of a turnaround? For value investors, the reality of trading apparently underpriced stocks is that some just don't ever recover. But there are tools at hand to help avoid these so-called value traps. One of them is a checklist designed to root out shares with the best chances of success - it's called the Piotroski F-Score.

The F-Score was introduced in 2000, in a paper by accounting professor Joseph Piotroski, who's now at Stanford Business School. His research aimed to find a way of determining which bargain price shares would flourish rather than falter.

His work led to the creation of a nine-point accounting checklist that looks back over a company's historical financial performance to spot tell-tale signs of improvement or deterioration.

An accounting obstacle course

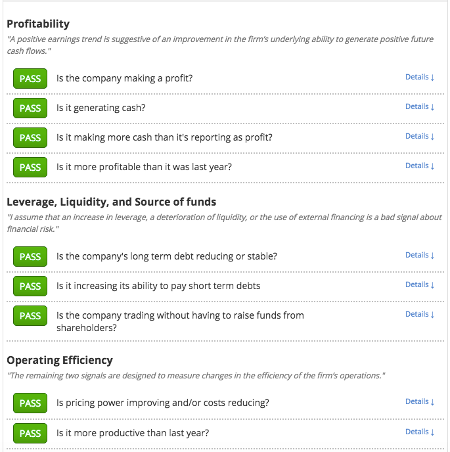

Piotroski's nine checks are spread between three key areas of financial analysis. The first is profitability, where the F-Score examines operating profits and cashflow to ensure the business can sustain itself and even pay dividends. Crucially, these checks look for an improving trend in profitability, which in underpriced and potentially misunderstood stocks can be a sign that a turnaround is under way.

Three of the nine F-Score checks look at the capital structure of a business, and can raise potential balance sheet red flags. They assess whether a company is improving its capacity to service both long and short term debt, or if it has to fund operations by issuing more shares.

Finally, the F-Score looks at whether the firm's operating efficiency is improving by looking for improvements in gross margins and asset turnover.

Piotroski originally designed his F-Score on the basis of analysing the cheapest stocks in the market based on price-to-book value. His studies found that those with the highest financial strength often went on to outperform - on average by 7.5% annually over a 20-year backtest.

Since then, though, the checklist has been adopted by professionals as a key measure of the financial and business strength of any company. Back in 2008, highly respected analyst James Montier (now at GMO LLC) showed how you could use the F-Score in a very different way. He devised a short-selling strategy that deliberately looked for companies with low F-Scores because they were likely to underperform - and his work showed that they did. More recently, investment bank Societe Generale has used the F-Score as one of the main "quality" rules in its global "Quality Income" dividend index.

Screening the market for high F-Scores

To get an idea about which companies in the market currently have some of the highest F-Scores, Stockopedia created a screen for Interactive Investor. In this case we've done away with specific valuation rules. But we have included Stockopedia's StockRank, which shows each company's market rank based on the strength of its overall quality, value and momentum - from zero (poor) to 100 (good). We have also included the relative strength of each share against the market over the past 12 months.

| Name | Mkt Cap £m | Piotroski F-score | Stock Rank™ | 1 Year Relative Strength |

| Cineworld | 1,498 | 9 | 87 | 78.9 |

| Pets at Home | 1,420 | 9 | 89 | 65.4 |

| Persimmon | 6,287 | 9 | 97 | 63.2 |

| Card Factory | 1,306 | 9 | 92 | 62 |

| Carnival | 26,874 | 9 | 88 | 39.8 |

| Source Bioscience | 56.7 | 9 | 80 | 35.8 |

| Debenhams | 997.1 | 9 | 98 | 31.7 |

| B&M European Value Retail SA | 3,350 | 9 | 61 | 29.6 |

| Pace | 1,172 | 9 | 94 | 22.4 |

| SABMiller | 60,939 | 9 | 68 | 13 |

The list is dominated by mid-cap stocks and has a leaning towards cyclical shares. Among them is cinema chain and retailers , , and . Drinks giant and bid target is by far the largest company here, with a market cap of £60.9 billion. The smallest company on the list is healthcare and biopharma services business, Source . Elsewhere, others scoring a maximum nine out of nine against the F-Score checklist is housebuilder , cruises company and set-top box maker .

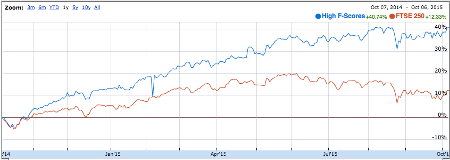

With the benefit of hindsight, this portfolio of shares would have produced a return over the past year of 40.7%, versus just 12.3% from the FTSE 250.

Joseph Piotroski's highly respected academic research has given investors a ready-made checklist to assess the financial strength of companies. In the context of deep value investing, of course, detailed research is essential because of the risk of individual stock disappointments. But the F-Score can also be a useful tool across different investment styles. For any investor looking for a way of assessing the trends in a company's financial track record, the F-Score could be a useful place to start.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.comand learn more about the site.

● Interactive Investor readers can enjoy a two week free trial and £50 discount to Stockopedia using the coupon code iii014 -click here.

● To learn more about Ben Graham and his deep value investing strategies, you can download the FREE Stockopedia book, How to Make Money in Value Stocks

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

About the author

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.