Model Portfolios and Rated Funds to see you through retirement

22nd October 2015 13:45

The abolition of the requirement to buy annuities at retirement and the freedom to take your pension fund and do what you want with it have been widely welcomed.

However, the changes have presented retirees with a new set of problems: they now have to decide for themselves how best to use their pension pots to support themselves in retirement.

This is no easy feat. There are many different options to choose from, and the financial regulator is concerned that pensioners may be persuaded to fall for too-good-to-be-true investments that turn out to be scams.

Moreover, even if you stick to legitimate investment opportunities you can go wrong. Putting all your money into a building society account, for example, would not be the best way to preserve the value of your pension pot over a 20 or 30-year retirement.

On the positive side, though, UK retirees are fortunate to have access to many funds and investment trusts which could serve them very well in a variety of retirement scenarios. The problem is choosing the best products from the thousands of funds and trusts available.

You should consider paying for independent financial advice. Alternatively, if you pay only for a financial planner's holistic insights, you may want to make your own investment decisions.

(Click to enlarge)

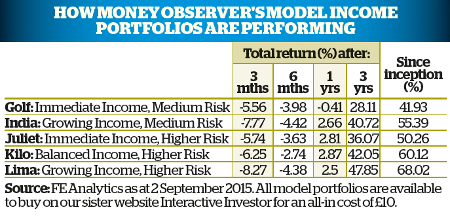

Interactive Investor's sister site Money Observer has tried to help narrow your choices through its Rated Fund listings and Model Portfolios, so here we look at how some specific recommended funds and portfolios might fit into your retirement planning, depending on your specific circumstances.

Remember, you can buy the Model Portfolios for just £10 through Interactive Investor.

Funds for a low life expectancy

Unfortunately not all of us will be in the best of health when we reach retirement. If you do have a serious medical condition and are not expected to live to a grand old age, you do not need to worry so much about the long-term growth potential of your capital and income. You should enjoy life while you can.

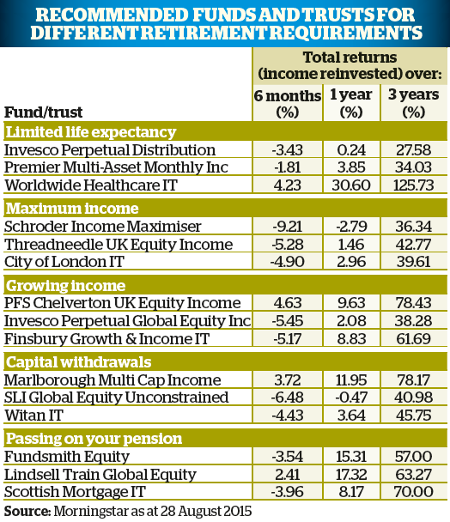

The best investments for you are therefore likely to be those which generate a good income but also allow you to dip into your capital with impunity for extra spending money. Three of our Rated Funds that could fit the bill are , and the .

The first two pay good yields, and they are invested in a mixture of assets so they should not be too volatile. Worldwide Healthcare invests in the pharmaceutical and biotechnology industries, a sector that may be of special interest to you, and focuses on generating a high level of capital growth that you could skim off.

If you want a ready-made portfolio on the other hand, our immediate income, higher-risk model Juliet, is worth considering. Although it is mainly focused on income generation, withdrawals of capital can also be made. It consists of six funds, invested mainly in shares but also in property and bonds.

Funds to maximise your income

If your resources are limited and you need your investments to generate as much income as possible, as soon as possible, this may mean sacrificing some growth potential. However, you still need to think about the long term, so investing in equity funds that aim at least to maintain the value of your income is advisable.

The best funds for you are therefore likely to be those where the manager's priority is delivering a high level of income, and which have an excellent track record of having achieved this goal.

Three of our Rated Funds which should deliver the goods are , and .

Schroder Income Maximiser targets a yield of 7%. Options are sold on the shares in the fund in order to boost its yield, but some of the potential capital growth is given up as a result of this strategy.

The other two are conventional UK equity income funds. City of London has a formidable record of nearly 50 years of dividend increases.

For a ready-made portfolio, we would suggest our immediate income, medium-risk model, Golf. This portfolio includes Schroder Income Maximiser and Threadneedle UK Equity Income, alongside four other funds investing in equities, bonds and property.

Funds for a growing income

If you are fit and healthy and planning a long and active retirement then it is important that you try to ensure your income goes on rising throughout your retirement. Exposure to smaller companies and global markets helps to provide this potential.

So the best funds for you are those that focus on long-term success rather than immediate rewards. Although there are no long-term guarantees, three of our Rated Funds that appear to have good future potential are , and .

The Chelverton fund invests in the shares of UK small and medium-sized companies. Nick Mustoe, manager of Invesco Perpetual's fund, looks for companies that can sustain profit margins and deliver returns in all economic conditions, while Finsbury Growth & Income's manager, Nick Train, aims to find companies in the UK and overseas that own durable and cash-generative brands.

If you would prefer a ready-made portfolio, our growing income, medium risk model, India, may be suitable. It invests in six equity funds investing both in the UK and also globally, plus one strategic bond fund for diversification.

Funds for ad hoq capital withdrawals

If you are one of the lucky ones who has spent part of your working life as a member of a final salary scheme that will provide you with a good, reliable basic pension, but has also paid into contribution-based schemes, you may prefer to use the latter pension pot for ad hoc capital withdrawals when you need extra cash.

If this is the case, the type of funds which are likely to be best for you are those that have the most potential for capital growth, although this does not rule out income-generating funds, as reinvested dividends can help to boost growth.

Three of our Rated Funds which could be useful in this context are , and . Although the Marlborough fund is aimed at providing a good income, it tends to invest in medium and smaller businesses which give it good growth potential as well.

The Standard Life and Witan funds are both globally invested funds, but the two have very different approaches. Standard Life's offering is concentrated, typically with just 50 holdings, so it involves high risk. Witan's portfolio uses a combination of direct investment and external managers so it is very diversified, which helps to reduce risk.

A ready-made portfolio which could be used for this purpose, though it is income-oriented, is our balanced income, higher risk model, Kilo. It invests mainly in UK and overseas equity funds, plus one bond fund for diversification.

Funds for passing on your pension

As a consequence of the rule changes introduced along with pensions freedom, it is now a very tax-efficient option to pass on your pension pot on death to beneficiaries.

If you die before 75 it can be passed on as a lump sum tax-free; if you die after 75, from April 2016 it will be taxed as earned income. So if you already have a good pension, or have other savings that you can use, you may prefer to leave your pension to accumulate for beneficiaries.

The best funds for this purpose are likely to be those focusing on long-term growth. Three of our Rated Funds that we would recommend are , and Scottish Mortgage investment trust. All three funds invest globally in a range of high-quality businesses, strong brands and companies with strong growth potential.

Among our ready-made portfolios, the growing income, higher-risk version Lima could fit the bill. Investors can opt for income to be reinvested into the funds to boost growth. Scottish Mortgage is one of the constituents, along with a range of other funds and trusts invested in UK and international equities.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks