The stockmarket in November

28th October 2015 11:49

by Stephen Eckett from ii contributor

Share on

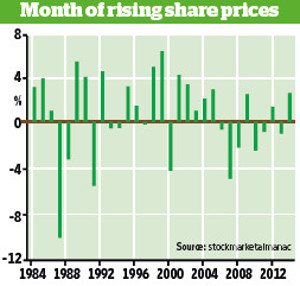

Stockmarket performance in November tends to be relatively middling compared to the rest of the year. Since 1970 the FTSE All-Share index has risen in November in 60% of years, with an average return over the period of 0.3%, ranking it in sixth place for monthly performance.

From 1980 its relative performance steadily increased, but that trend reversed in 2006; as can be seen in the chart below, the market has risen only three times in November in the past nine years.

The significant feature of November is that it marks the start of the strong six-month period of the year (November to April). In other words, having reduced exposure to equities in May ("sell in May and go away..."), investors should now be increasing exposure to the market this month, if they haven't already done so in October.

Strong final week

On average the market tends to rise over the first four days of the month, then give up those gains over the following few days, rise again and fall back, before increasing quite strongly over the final seven trading days of the month.

In the past 20 years the sectors that have been strong in November have included beverages, fixed line telecommunications, food producers, life insurance, media, mining, technology hardware & equipment and travel & leisure.

The weak sectors have been aerospace & defence, banks, general industrials and oil & gas producers.

At company level, the following FTSE 350 shares have performed best in November in the past 10 years: , , and ; the shares of these companies have all risen this month for nine of the past 10 years.

The shares that don't like November include , and . Finally, it's a busy month for interim results: 62 companies from the FTSE 350 have announcements this month.

Stephen Eckett is author of The UK Stock Market Almanac 2015.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.