Tech IPO Softcat sizzles on debut

13th November 2015 13:42

by Harriet Mann from interactive investor

Share on

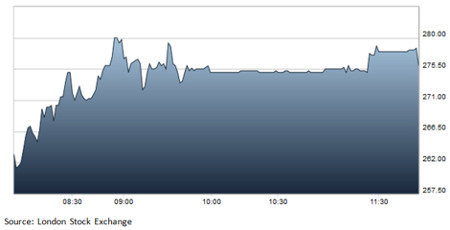

A month after confirming plans to IPO in London, software reseller has got its float away in spectacular fashion. Within an hour of the opening bell, the shares had risen 20%, pricing the 22-year-old company at £568 million. And that very much follows the trend for this year's handful of tech IPOs during the past five weeks (see chart below).

Pricing its IPO at 240p a share, or £472 million, Softcat has delivered a windfall for senior staff. They'll pocket at least £153 million, but it could be as much as £176 million if the entire over-allotment option is exercised. Founder Peter Kelly is understood to have offloaded a third of his 52% stake, netting a cool £88 million.

Softcat's shares initially rallied close to 290p Friday, although the price had settled to 275p by mid-morning. Clearly the City is excited: "The successful pricing of our initial public offering on the London Stock Exchange reflects the very positive response we have received from institutional investors as we have shared our equity story in recent weeks," said chief executive Martin Hellawell.

(click to enlarge)

This follows security company and payment processor group 's flotations earlier this year, which have since grown by 13% and 5% on the market respectively. Share registrar has also recently been flirting with an IPO.

Launched by Peter Kelly in 1993, Softcat sells IT solutions to improve the technology, infrastructure and security of small and medium-sized businesses, as well as larger firms and the public sector. The firm, which became the largest supplier of software licencing within just four years, also works with , , and . It's also recently been voted second best place to work in the UK.

(click to enlarge)

And Softcat certainly joins the market in good health. Its customer base has tripled since 2007, sales surged by 50% to £596 million in the three years to 31 July and adjusted operating profit jumped 44% to £40.6 million over the same period. A head-turning average cash conversion rate of 109.2% underpins a pledge to pay annual dividends worth 40-50% of post-tax profit.

Softcat has a stellar management team behind it, too. Hellawell, who also bagged a fortune from the listing, is no stranger to IPOs after floating in 1998; chairman Brian Wallace has had stints at and Group; and number cruncher Graham Charlton has experience at comparethemarket.com. Vin Murria, currently a non-executive director at and also joins the board.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.