Buy-to-let lenders can survive Osborne's attack

26th November 2015 13:22

Investors have had 24 hours to mull over the Chancellor's Autumn Budget and Spending Review, particularly plans to give people a leg-up on the housing ladder. Of course, the devil is in the detail and, after burning the midnight oil, we now have a clearer idea of what impact City number-crunchers think higher buy-to-let stamp duty will have on the listed mortgage lenders.

It came as no surprise that housebuilding was among Osborne's priorities: the government wants to build 1 million new homes over the next five years - around 50,000 every three months - but the number of new builds stalled at 35,000 in the second quarter.

In what's been dubbed the largest housebuilding investment since the 1970s, the chancellor has doubled the annual housing budget to £2 billion in a bid to play catch-up, which should bankroll 400,000 affordable homes.

And that wasn't all. Osborne has removed restrictions on shared ownership, extended Right-to-buy and launched a London Help-to-buy initiative: those who have a 5% deposit will get an interest-free loan worth up to 40% of the house value.

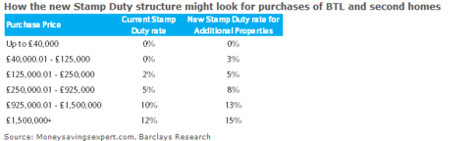

In an attempt to protect the first-time buyer market from buy-to-let landlords and multiple home owners, Osborne will also introduce a new additional stamp duty rate of 3% on buyers' second homes from April 2016.

In September, the Bank of England's Financial Policy Committee warned that the rapidly growing buy-to-let market will exacerbate housing and credit cycles. This could cause a surge in house buying over the next five months.

'Negative for sentiment, little impact on volumes'

As UK housing has returned an average 7% compound annual growth rate (CAGR) over the last 30 years, investment bank UBS doesn't think the attractive investment case will diminish with the additional one-off 3% duty tax.

"Although this is negative for sentiment, we would expect little impact on volumes," explains analyst Ivan Jevremovic.

"We also expect that potential increases in housebuilding as a result of measures announced in the Autumn Statement would ultimately support mortgage volumes."

How the extra tax will be calculated is unknown - will the £40,000 threshold create a new band, or will the first £125,000 still be tax free? Analysts at Barclays have done their best to come up with a prototype overnight (see chart below).

With the average UK property price at £250,000, Barclays reckons most recent buy-to-let purchases are valued around £200,000.

(click to enlarge)

"For properties within this £200-250k bracket, the amount of stamp duty paid could increase by 4-5x the current amount (from £1,500-£2,500 to £7,500-£10,000), which would make affordability more difficult, particularly for amateur landlords.

"The effect is more muted if the first £125,000 will still remain tax-free rather than increase to 3%, resulting in a less severe but still considerable 2.5x increase in stamp, to £3,750-£6,250.

"The more expensive the property, the lower the proportional increase in tax, broadly levelling out at an 80-100% increase in stamp for properties of £500,000 value and above."

As corporates will have to pay neither the higher tax, nor changes to tax relief announced in the Summer Budget, Barclays thinks more professional landlords will become incorporated as a result.

These are the customers that challenger banks are targeting anyway, making up over half of 's customer base. Barclays expects it could be 45% of 's and 's clients, but just a minority of 's.

(click to enlarge)

Minimal hit to lender earnings

Shares of companies with a high level of buy-to-let lending have been weak since October amid fears of further regulatory change. Indeed, Paragon, OSB and are all off 8-14% since early October, versus a FTSE All-Share roughly flat.

With significant exposure to buy-to-let mortgages - about 93% of its stock and 96% of new loans in 2015 - Paragon's share price has slipped 6% since Wednesday morning, to 372p. Although just over half of OSB's total loan book is buy-to-let, the source is gaining significance and accounts for 80% of new loans this year. The shares have fallen 3% to 352p and by 13% in the past week.

Although OSB has one of the largest exposures to buy-to-let mortgages, the Autumn Statement is not expected to have much impact on group earnings forecasts, and Investec has upgraded the stock from 'hold' to 'buy', with a 375p price target.

Buy-to-let mortgages make up just over 40% of both Shawbrook and Aldermore's total loan books and just over a third of new mortgages, but the former has stumbled just 1% to 330p, whereas Aldermore crashed 8% to 238p. Virgin Money was the only challenger bank to rise, up 2% to 360p.

"OneSavings has lost its premium rating and now trades on 7.5x 2017e EPS," says Investec analyst Ian Gordon. "We now see considerable value right across the sub-sector, with Aldermore ('buy'), Shawbrook ('buy') and Virgin Money ('buy') trading on 7.0x, 7.8x and 8.1x 2017e earnings per share (EPS) respectively."

Barclays is broadly positive, too. It tips Aldermore up to 310p, OneSavings Bank at 375p, Paragon Group at 475p, and Shawbrook at 400p.

And UBS repeats its 'buy' rating for Virgin Money, Paragon and .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks