FTSE 100's safest and riskiest dividends named

27th November 2015 16:48

by Lee Wild from interactive investor

Share on

Dividend income is still one of the biggest shows in town, and above-inflation increases in the annual payout are highly prized. It's down to record low interest rates which make generating anything like decent income from other liquid asset classes incredibly difficult. But not all blue chip dividends are safe. In fact, some are downright dangerous.

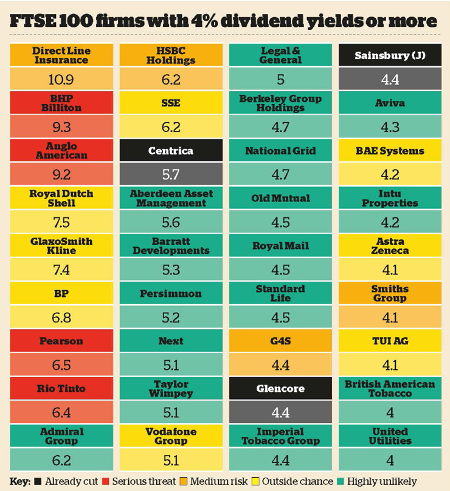

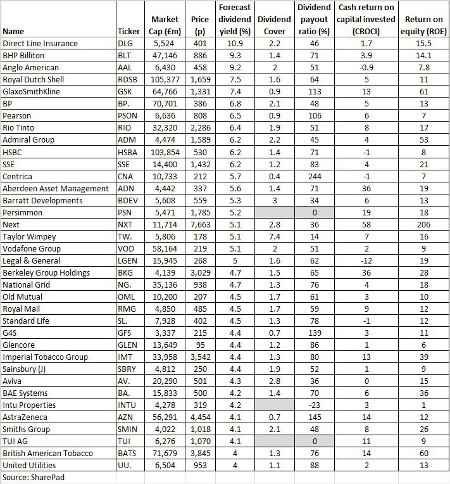

We've put together a colour-coded graphic (see below) which includes every company currently yielding 4% or more. It's accompanied by some relevant data (bottom of the article), which together give us a pretty good clue whether dividends are sustainable, and who might be next to cut, or even scrap the payout.

We've included dividend cover as a key measure of affordability, of course. It tells us how many times a company can pay its dividend from profits, and is probably the first measure investors look at when judging a company's ability to return cash to shareholders. Anything less than 1.5 times may cause sleepless nights.

Then there's the payout ratio – the percentage of earnings paid out to shareholders as dividends. A figure of around 60% would be considered attractive, but a drop in profits may mean some companies pay out 100% or more. That implies they're borrowing to keep dividend seekers happy, which is not a long-term solution.

It's worth looking at return on equity (ROE), too. It shows how much a company makes with each pound of shareholders' equity. But while it can be useful, the measure might not always tell us the whole truth. Either writing down assets, or raising debt would reduce book value, increasing ROE.

That's why a lot of professional investors use cash return on capital invested (CROCI). It's a valuation multiple which calculates how much free cash flow per pound is generated by the company from invested capital. It removes non-cash items like depreciation and amortization, and tells us a lot about management performance and how strong the underlying business is. Again, a higher ratio is better.

Below, we cover some of the more interesting dividend stories among the most generous blue-chips. The colour coding is self-explanatory – red means the dividend is in serious danger, green implies safety. As well as our own discretion, we've taken inspiration from analysts, fund managers and market chatter to measure confidence in each company's dividend prospects.

(Click to enlarge)

Who's safe, who's not

A trio of miners make it into the FTSE 100's top 10 payers, among them with a killer yield of over 9%. But BHP faces fines which could reach billions of dollars after a tailings dam at one of its mines in Brazil collapsed. Locals died and the clean-up operation will be expensive. Even chief executive Andrew Mackenzie, who recently suggested the dividend would be cut "over my dead body", is sounding less certain.

The mood in the City has certainly deteriorated. "We assume the FY16e dividend will be cut by 50% to $0.62, and this could happen at the interim results [in February]," said Societe Generale this week. "Despite this, on our new numbers, our [free cash flow] forecasts barely cover our lower dividend expectations in the FY16-18e period."

And JP Morgan believes the Samarco tailings dam failure will be "the straw that breaks the camel's back on BHP's progressive dividend". It, too, predicts a 50% cut, this time at the final results in August. However, even then BHP would offer a yield of 4.5-5%.

It's not looking great for either. The education company is loaded with cash after selling the Financial Times and a 50% stake in The Economist. But broker Berenberg has just cut its earnings per share estimates for 2016 by another 7%, having already dropped forecasts by 15% following a recent profits warning. "In our view, this makes it even more likely that the dividend will need to be reset," it says. "We expect a new chairman to make that decision in early 2016, when the outlook for the year becomes clearer."

We've said before that is unlikely to cut the dividend for the first time since World War II, but there is an outside chance, and for , too. BP chief Bob Dudley may have set out plans, which "underpins our strong priority of sustaining our dividend," but with oil likely to remain lower for longer, we'll see. JP Morgan analyst Fred Lucas said last month Big Oil's positive rhetoric on dividend sustainability is "not credible".

Some have expressed doubts about the sustainability of dividend, too, although Investec is backing a rising payout at least for the next three years, giving a yield of 6.5-7%. UBS agrees. It thinks investors are now being "adequately compensated" to wait for the end of a debt reduction process which could take another couple of years.

And insurer , the biggest payer in the blue-chip index, also looks a decent bet, although we've allocated a 'medium risk' rating to the dividend just because that knockout yield relies heavily on special payouts. The companyhas already paid out 87p - half its IPO price – in dividends since floating three years ago, and most do expect another special for the full-year.

Direct Line has been waiting to see what Solvency 2 EU insurance regulation looks like before handing more cash back to shareholders. It's why it didn't pay a special at the half-year results. But Barclays thinks another spectacular return to shareholders is inevitable: "We believe there is a potential for a 20.4p special dividend at the FY16 interim results, for a total FY16E yield of 9%."

(Click to enlarge)

acquisition of Friends Life will also guarantee generous dividends at the insurance giant, generating big savings and drive "significant dividend growth and capital return," reckons Barclays. It transforms Aviva's cash generation and "makes the stock into a very attractive dividend stock in a market searching for yield". It does, but it must improve cash flow, too, just to make sure.

payout looks sound enough for now, and management is expected to "pull out all the levers" before rebasing the dividend. But there is a threat if commodity prices stay lower for longer, and SSE may need a rights issue if it does bid for gas distribution assets.

Among the cutters, the view remains that all three will pay dividends next year. Some, however, look more likely than others. A level of payout looks odds-on at , and British Gas-owner , which experts think must compensate shareholders for a lack of visibility on earnings.

Surprisingly, is still tipped to yield something in 2016 despite recently suspending the dividend "until further notice". This year's final and the 2016 interim are axed, but debt will have to have fallen dramatically – at least by the targeted $10.2 billion - before the struggling miner and metals trader returns to the dividend list.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.