Why all UK banks will survive a crash

1st December 2015 12:16

by Lee Wild from interactive investor

Share on

Both and failed part of the Bank of England's (BoE) second annual stress test, designed to assess the resilience of UK banks to a major slump in the global economy.

The other five lenders tested - , , , and - all passed with flying colours, sending the FTSE 350 bank index up over 2% Tuesday.

However, even RBS and Standard's share prices rose 3% and 1.7% respectively. That's because neither will need to submit a revised capital plan, as the tests were based on the banks' positions at the end of 2014. The BoE's banks supervisor, the Prudential Regulation Authority (PRA), decided both had already done enough to address the shortfall.

This year, the BoE tested a five-year scenario out to 2019, in which global growth plunges by almost 7%, China expands by just 1.7%, oil prices sink to $38 a barrel, and the eurozone suffers three years of deflation. Volatility goes through the roof, a soaring dollar depreciates emerging market currencies by a quarter, and another slug of misconduct costs wipes out around £40 billion of banks' pre-tax profits over the period.

'More positive than expected'

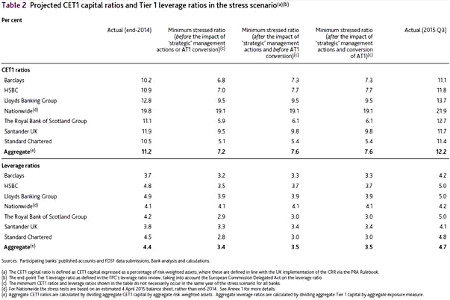

Despite that, RBS's 5.9% Common Equity Tier 1 (CET1) capital ratio - a measure of financial strength - passed the 4.5% post-stress minimum threshold set by the BoE.

Its Tier 1 leverage ratio of 2.9% was shy of the 3% required, although management actions did nudge it up to the required level. Ewen Stevenson, finance chief at the lender still 72.9%-owned by the taxpayer, admitted it has "much to do to restore RBS to be a strong and resilient bank for our customers".

Standard's CET1 ratio of 5.1% was fine, but its leverage ratio of 2.8% fell short. Still, new chief Bill Winters' strategy review and fully underwritten £3.3 billion rights issue improves its position, and the Far East-focused lender is operating with capital levels above current minimum regulatory requirements. It also has "a number of additional levers at its disposal to further manage capital," according to Winters.

"Overall, this reads more positively that we expected," says Deutsche Bank analyst David Lock.

"The [Financial Policy Committee (FPC)] is being explicit in saying that for the sector overall it is not increasing capital requirements further, it has taken into account [risk-weighted assets (RWAs)] definition changes, and is seeking to minimise the motivation to hold additional voluntary buffers due to regulatory uncertainty.

"This is a positive, particularly for Lloyds (already at a 13.7% CET1 ratio at third-quarter 2015) where distributions are particularly geared to capital requirements."

(click to enlarge)

Lloyds 'top of listed players'

Lloyds, because of its domestic focus, came out top of the listed players, "comfortably" exceeding thresholds with a CET1 of 9.5% and leverage ratio of 3.9%.

"These strong results…demonstrate the progress we have made in de-risking our balance sheet as well as the group's strong capital position and capital-generative business model," said CEO António Horta-Osório.

For Barclays, the minimum stressed CET1 ratio of 6.8%, before the impact of strategic management actions, exceeded the minimum threshold by a significant margin, while the leverage ratio came in at 3.2%.

At HSBC, a CET1 ratio of 7% before management actions of 7% was second-best of the UK listed banks, as was a leverage ratio of 3.5%, coming in behind Lloyds on both measures.

"Our intention, as evidenced by past actions, is to maintain a conservative and prudent stance on capital management," it said.

(click to enlarge)

It's also worth noting that the FPC's Financial Stability Report does mention the use of countercyclical capital buffers (CCBs).

A 'mending the roof when the sun is shining' approach would help preserve balance sheets when conditions deteriorate. This could require banks to hold as much as £10 billion in additional capital, according to reports. It could be implemented as early as next March.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.