Market Death Cross imminent

8th February 2016 10:11

by Lance Roberts from ii contributor

Share on

The Monday morning call

The market bounce failed much sooner than anticipated. This changes the tone of the market to substantially more bearish.

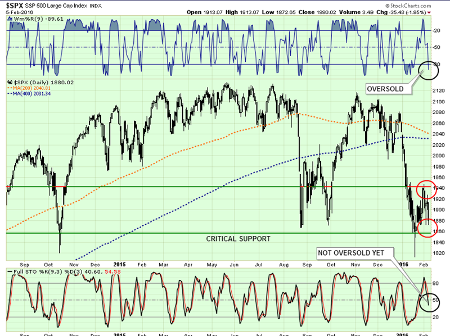

As shown in the chart below, on a very short-term basis the market is oversold and once again suggests the markets could get some buying early next week. However, they are also on the verge of breaking critical support.

I continue to suggest taking actions to reduce risk in portfolios by taking the following actions on any rallies:

• Trim back winning positions to original portfolio weights (investment rule: "let winners run").

• Sell positions that simply are not working; if the position was not working in a rising market, it likely won't in a declining market (investment rule: "cut losers short").

• Hold the cash raised from these activities until the next buying opportunity occurs (investment rule: "buy low").

One other point: The two moving averages in the chart above are the 200-day and 400-day. As you will notice, they are about to cross. Because these two moving averages are so long in nature, they will cross. It is now inevitable unless the market immediately reverses to a runaway stampede higher.

This "real death cross" was brought to my attention earlier this week by a loyal reader:

Most identify the death cross as when the 50-day moving average breaks below the 200-day moving average on the S&P 500. However, the real death cross takes place when the 200-day moving average crosses below the 400. In 13 of the last 18 major correction episodes going back to 1920 - that's 72% of the time - this crossover marked the onset of a major bear market.

In the five exceptions, which were 1953, 1990, 1984, 1987, and 1996, the same crossover actually ended the correction at that time. Importantly, these five episodes were during strongly trending secular bull market cycles. Given we are not currently in one of those periods, it is likely a cross-over now would be more related to each of the market failures since the turn of the century.

As I stated above, I am not "predicting" anything. What I am doing is suggesting that current trends, based on historical precedents, suggests that "something wicked this way comes".

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In