Time to sell this rally?

15th February 2016 09:46

by Lance Roberts from ii contributor

Share on

The Monday morning call

The good news is that you can "walk, rather than run, to the exit."

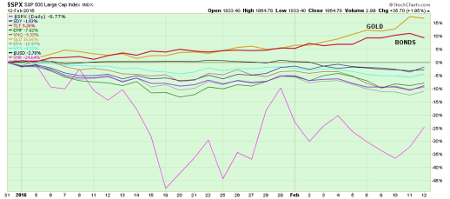

As shown in the chart below, on a very short-term basis the market is oversold and the bounce on Friday was just enough to close above the October low's support at 1,860. Any continued rally next week should be used to further reduce equity risk and rebalance portfolios.

Unfortunately, we have had a series of failed one-day rallies over the past couple of months, so it is advisable not to try and game the market at this juncture.

I continue to suggest taking actions to reduce risk in portfolios by taking the following actions on any rallies:

• Trim back winning positions to original portfolio weights - investment rule: "let winners run".

• Sell positions that simply are not working (if the position was not working in a rising market, it likely won't in a declining market) - investment rule: "cut losers short".

• Hold the cash raised from these activities until the next buying opportunity occurs - investment rule: "buy low".

Gold

We are watching money seek safety inside of "dividend stocks". But, unlike utilities, dividend stocks are not posting gains overall this year. What is making money, as "fear" rises in the markets, is gold and bonds.

While gold has shown some signs of life as of late, it is still too early to add this asset class to portfolios. At the beginning of 2012, I wrote in this missive that investors should exit gold. While gold is improving, it is still trapped in a long-term downtrend. When the downtrend is reversed, the reward/risk ratio will once again be favourable to add this asset class back into portfolios.

Gold is a very speculative and volatile asset class. Gold is not a hedge for inflation. Gold is not an alternative currency. Gold will not protect you in an economic meltdown. For that, you should own lead, with which you can get all the gold you want.

We may be approaching a point soon where gold can be added to portfolios, but that time is not now. Furthermore, it is important to note that, in 2008, as shown above, gold lost more than 30% of its value during the panic to "sell out" of the market. It was not a "hedge" against the decline. That will likely happen again if a similar correction in the markets occurs.

Overall, this is still a very dangerous market. Deterioration is still prevalent economically, fundamentally and technically. Caution is highly advised until a more bullish setup emerges.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In