Winter Portfolios warm up in February

4th March 2016 17:33

by Lee Wild from interactive investor

Share on

Seasonal investing is nothing new. Statistics going back 20 years show that share prices do best during the long winter months. This anomaly has made smart investors substantial profits for two decades, and last year we launched our own model portfolios based on the simple trading strategy. They were so successful we've done it again.

Known as the six-month strategy, all investors need do is buy a basket of shares on 1 November and sell on 30 April. Investing in the market between these dates only for the past 20 years would have turned £100 into £316. Over 10 years, it would have made twice as much profit as staying invested all year round.

A year ago, we screened the FTSE 350 for the five stocks with the best record of returns between November and April over the past decade - the Interactive Investor Consistent Winter Portfolio. Last year it made a 14% profit compared with 8.7% for the FTSE 350 benchmark index.

We also relaxed the rules slightly to include companies with a track record of at least nine years, but which must have risen at least three-quarters of the time over the past 10 years - our higher risk Aggressive Winter Portfolio. Last year, it returned an impressive 16.9%.

Investing in this year's Consistent portfolio every winter for the past decade would have generated an average gain of 24% (excluding dividends) compared with an average of 5.4% for the FTSE 350. Gains for the Aggressive portfolio wold have averaged over 35%, seven times more than the benchmark.

Here's a round-up of the highlights and lowlights from the fourth month of this six-month strategy.

A crazy February

It's been a stomach-churning ride since the peaked at 7,122 in April last year, but however much you think you're prepared, February would have tested even the coolest cucumber in the Square Mile.

A 10% slump over the first 11 days of the month to July 2012 lows piqued interest among bargain hunters though. That triggered a wave of buying that quickly developed into a 600-point, or 11%, rally over the remainder of the month.

Include mid-cap stocks and the FTSE 350 index, the benchmark for our winter portfolios, was up just 0.3% last month, and is down 4% since the six-month strategy kicked off on 1 November.

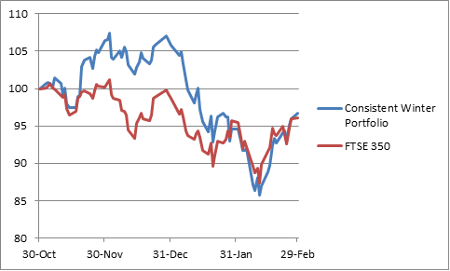

Consistent Winter Portfolio

After a proper thrashing during the utter carnage that was January, our Winter Portfolios staged an impressive fight back in February. The 'consistent' basket of five shares has always outperformed the FTSE 350, so it was a shock to see the benchmark beating our winter winners.

Thankfully, the situation was corrected as the month drew to a close and our portfolio finished the month with a 2.3% gain versus the FTSE 350, up just 0.3%. It means that the portfolio is now down just 3.2% over the first four months of the strategy compared with a 4% decline for the benchmark.

Predictably, our reliable speciality chemicals high-flyer led the way, jumping 4.2% in February. Full-year results toward the end of the month justified the surge from mid-month lows.

Record sales and pre-tax profit following growth across the business bankrolled a 5% increase in the ordinary dividend plus a 100p per share special dividend.

Profit downgrades followed full-year results early in the month, but its shares still ended the month up 3.7%. Its Process Technologies and Precious Metal Products business continued to hurt third-quarter profit, although it does expect a strong final quarter.

Irish building materials firm had a strong month too, and bashed-up equipment rental company clawed back 2.8% of its deficit since the strategy began in November. Workspace provider was the only faller, down 2% despite bouncing 11% off its mid-month low.

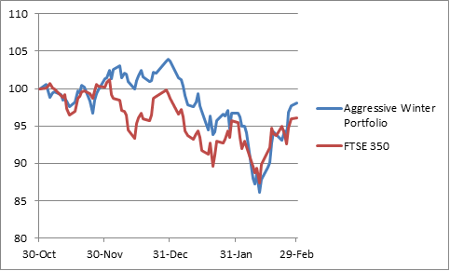

Aggressive Winter Portfolio

Our Aggressive Winter Portfolio has ridden the volatility well and, after a 1.4% gain in February, is down just 2% overall.

is clearly over its failed attempt to buy both and Ava Trade. The £2.7 billion gaming software company racked up a 10% gain in February and is close to breakeven for the four months.

It reported another year of double-digit underlying revenue growth, easily beating market expectations. It's also in talks on a number of acquisitions, although money will be returned to shareholders if they come to nothing.

Even after this rally, the shares still trade at a discount to the peers. "Too cheap," shouts broker Canaccord Genuity. They think the shares are worth £10.

Star performer had a quiet month by its standards. The shares were flat on the month but still up over 18% since the end of October. Ashtead and Regus appear in both portfolios, so we know what happened there, but is a disappointment.

Ahead of results at the beginning of March (which were pretty good), its share price fell over 3%. Sentiment toward the housebuilding sector has deteriorated in recent months amid concerns that the London housing bubble is about to burst. Costs for on-site labour like bricklayers, carpenters and joiners are rising fast, too, although Wimpey now offers a prospective dividend yield of over 6%.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.