Time to trade volatility

18th March 2016 11:14

by Andrew Pitts from interactive investor

Share on

It was all just a storm in a teacup. As stockmarkets around the world rebounded by 10% or more from the lows seen in mid-February, that seems to be the conclusion that has brought the bulls back to equity markets.

This turnaround in sentiment, in less than three weeks, shows that the herd instinct is to the fore; it can all be traced back to the day Jamie Dimon, head of JPMorgan Chase, ploughed his entire $26 million (£18.4 million) annual bonus into the giant US bank's shares.

The cynic in me says that Dimon was already financially comfortable enough to take a punt on a rebound in bank shares without worrying too much if it didn't come off.

But mere private investors must ask: what's changed to justify the rapid switch from fear to favour?

Oil and stocks

Sure, oil has rebounded, from a trough of $25 for a barrel of Brent to around $37, and oil producers are mulling supply cuts, but it hardly warrants a 10% rise in global stockmarkets.

In the longer term, cheap oil will be an economic boon for importers, but that is not what interests global investors right now; they have moved from "risk-off" to "risk-on" without much reference to the global picture, which they prefer to gloss over.

For the stark facts are this: global trade is, at best, stagnant, as is global manufacturing. Forecasts for profits and earnings are being slashed.

In the US, for example, estimates for corporate earnings compiled by Thomson Reuters on New Year's Day for the first quarter of 2016 forecast a rise of an aggregate 2.3%; now those same companies expect a decline of nearly 6%.

In both the US and Europe, it is not only earnings per share (an easily massaged figure) that are falling, but actual profits are down too - by around 4% in the fourth quarter of 2015.

Global bond markets are suggesting a very different outcome from equity bulls. Institutional investors are increasingly willing to pay both central banks and governments for the privilege of lending them money or parking cash.

Eye of a storm

Last year we saw German government bonds trading at a negative yield, and they are barely positive now. In February Japan sold new 10-year bonds with a negative yield, guaranteeing a loss if held to maturity. These are not facts to ignore.

So it seems sensible to heed the words of Lord Rothschild, chairman of .

Commenting on the £2.4 billion investment trust's results for the year to 31 December, which saw an 8.1% net asset value total return and a 22.7% rise in share price, he says: "We became increasingly concerned about global equity markets during the last quarter of 2015, reducing our exposure to equities as the economic outlook darkened and many companies reported disappointing earnings.

"Meanwhile, central banks' policymakers became more pessimistic in their economic forecasts for, despite unprecedented monetary stimulus, growth remained anaemic.

"Not surprisingly, market conditions have deteriorated further. So much so that the wind is certainly not behind us; indeed we may well be in the eye of a storm."

It's that sort of pragmatism - a focus on capital preservation and limiting volatility via a mix of assets - that has seen the trust, one of our sister magazine Money Observer's Rated Funds, participate in 76% of stockmarket upside, but only 39% of the falls, since its launch in 1988.

Storm in a teacup? Glass half-full or half-empty? I prefer to believe that there's no smoke without fire, and we should act accordingly.

Trading the Vix

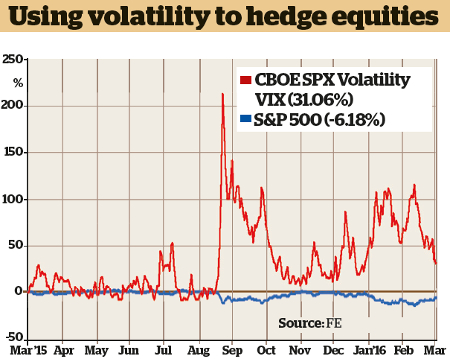

One way to trade short-term volatility in equity markets is via the Chicago Board Options Exchange Volatility index (CBOE), also known as the Vix, which tracks investor sentiment for the S&P 500 index in the US.

In a nutshell, CBOE describes this as "a pure play on implied volatility, independent of the direction and level of stock prices. Vix futures may also provide an effective way to hedge equity returns and to diversify portfolios".

Private investors can trade the Vix via UK stockbrokers that provide access to US exchanges.

Two products that I have explored on the Interactive Investor platform are , an exchange traded fund, and , an exchange traded note where price reflects double the daily movement of the Vix.

Wall Street's so-called "fear gauge" can be very volatile from day to day, so this is not a "buy and hold" strategy, or one for the fainthearted.

However, with the index falling back to 17 (on 3 March), compared with 28 on 11 February and 49 on 1 September, it could be a good entry point to profit from complacency about immediate stockmarket prospects.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.