A fund portfolio to help avoid judgement day

23rd March 2016 12:02

by Douglas Chadwick from interactive investor

Share on

Bill Bonner, the owner of MoneyWeek magazine, recently wrote the following: "Not for nothing do we have the present preposterous financial system where the borrower buys the things he doesn't need with money he doesn't have, and the lender lends money that no one ever earned or saved at the lowest interest rates in history.

"Anyone with any sense holds his breath...waiting for the day of reckoning that never seems to arrive."

This "saline canine" believes that the above opinion really sums up today's financial situation, and that one could be forgiven for feeling the only future ahead for investors must involve heading downstairs, wearing asbestos underwear and shovelling coal.

But perhaps, for the cautious, this is not the only direction and there are still opportunities to hold your ground and make some money.

Gold proves beneficial

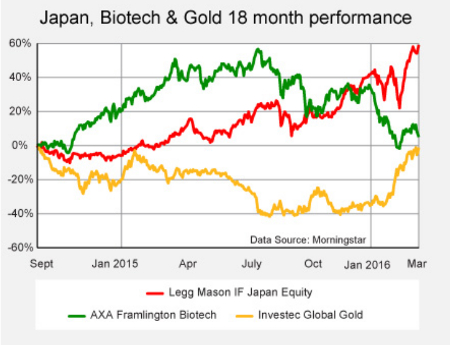

In last month's update we looked at a graph of the 18-month performance of the , and funds.

This graph has been brought up to date and you can see that the decision last month to make a small investment into the gold fund has proved very beneficial. It would also appear that Legg Mason Japan is now also worth an investment.

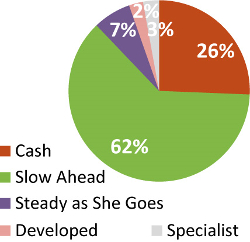

The cautious person following the Tugboat portfolio will stick with the bulk of his money in cash and the "Slow Ahead" group, where the slow property funds still continue to supply a steady and regular monthly gain.

Missed opportunity?

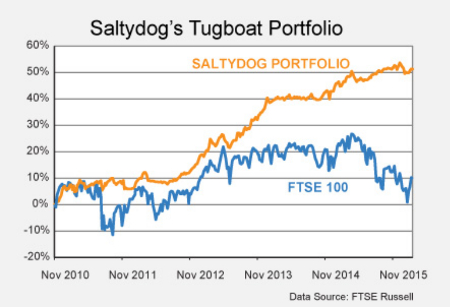

This approach is not going to set your blood racing, but you are not going to see your savings take that terminal dive.

It is also worth noting that some might say we missed an opportunity for gain by ignoring the Latin American funds which, along with the gold funds, made an appearance last month and have showed further gains this month.

Well, possibly with hindsight that is correct. However, we follow the profile of the Tugboat risk pie-chart which indicated a 3% holding in the specialist sector.

This is really not enough to make it worth holding both gold and the Latin American funds. We chose to run with the Investec Global Gold fund and that is producing the results for the moment.

I have reached that age when "happy hour" is a nap. So, for me, no gambling and adventure until the day of reckoning finally arrives and one can see a more constructive future.

Douglas Chadwick is a founder of Saltydog. For more information see their website.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.