The stockmarket in May: time to sell?

29th April 2016 13:28

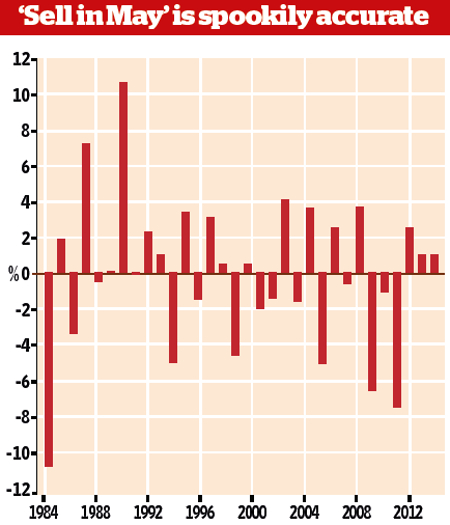

It's sell in May time again. Often stockmarket sayings turn out to be unreliable at best, but the "sell in May" aphorism is spookily accurate.

It describes the tendency of the market to be weaker from May to October than it is in the other half of the year.

Over the past 33 years the saying has been right 28 times and the average annual outperformance during November to April, since 1982, has been 8.6%; very few trading systems can match that record.

Usually stockmarket anomalies, once they have been identified, don't last long. But the "sell in May" effect has been around for decades: one academic paper found evidence of the phenomenon in the UK market in 1694. And the effect is as strong as ever.

Weakest month

For example, the FTSE All-Share index was up 7.3% over the six months from November 2014 to April 2015, and it was down 7.3% over the period May 2015 to October 2015 (a startlingly symmetrical performance pattern).

Given the strength of the sell in May effect, it is not surprising that May itself is one of the weakest months of the year for shares.

There are only three months during which, since 1970, the market has produced an average return of less than zero, and May is one of them (the others are June and September).

On average the market falls by 0.2%. The probability of a positive return in the month is less than 50%.

It's not immediately obvious why stockmarkets have been historically weak in May. The month lags in most stockmarkets around the world, so the effect is clearly not UK specific.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks