A medium-risk portfolio still beating the market

10th May 2016 17:30

by Marina Gerner from interactive investor

Share on

Each month our sister magazine Money Observer homes in on one of our 12 Model Portfolios, assessing its aims, the type of investor it may suit and how it has performed. This month Marina Gerner looks at : mid-term growth, medium risk.

What are the Money Observer Model Portfolios?

Money Observer's Model Portfolios are a collection of 12 theoretical investment portfolios, each consisting of a selection of six or seven funds and investment trusts (mainly Money Observer Rated Funds). They are designed to meet particular investment objectives, starting with income and growth.

Click here to view and buy the Model Portfolios

The six income and six growth packages are each tailored to different time horizons and risk profiles (medium or higher risk) by combining funds invested in different regions, sectors and asset classes.

What are Bravo's aims?

Bravo is mainly an equity portfolio whose objective is to produce capital growth over the medium term - about 10-15 years - with a moderate level of risk.

Bravo contains four active funds, one passive fund and one investment trust: , , , , and , respectively.

Kames Ethical Cautious Managed and EdenTree UK Equity Growth were selected to provide this portfolio with a good foundation of UK holdings.

The HSBC FTSE All Share Index fund ensures investors have additional broad exposure to UK companies of all sizes and, because it's a passive fund, helps keep costs down.

Three internationally invested funds, Ardevora Global Equity, Fundsmith Equity, and Witan, are included to spread risk further and extend the scope for gains.

Close to half the portfolio is invested in UK equities. A further 11% is in US equities.

For whom is Bravo designed?

Bravo is designed for people with investment time horizons of 10-15 years who are looking to grow their capital without taking too much risk but can afford to lose some of their capital in a worst-case scenario.

It may, for example, suit investors with young children seeking to build up capital for their family's further education or to help them with a first home deposit.

Investors in their late 40s or early 50s who want to build up extra retirement capital in an ISA might also consider this portfolio.

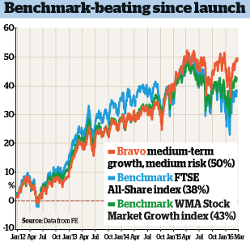

How well has Bravo performed?

This was ahead of the return from the FTSE WMA Stock Market Growth index, which returned 18%, and the FTSE All-Share index on 5.8% over the period.

An initial investment of £10,000 three years ago would be worth £12,845 today.

Over the past year it gained 0.7%, compared with a loss of 4.8% from the FTSE All-Share index.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.