FTSE 100 rally nears 500 points on polling day

23rd June 2016 13:37

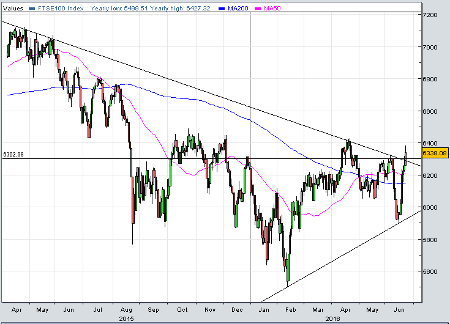

Either 'Remain' has won the EU referendum, or traders have possibly their worst error chasing shares higher since Thursday last week. During what looks like becoming a five-session rally, the FTSE 100 has surged by almost 500 points to a two-month high. So, which is it?

Well, if you believe opinion polls, you'd have to put your money on 'Remain'. An Ipsos MORI survey for the Evening Standard shows 52% in favour of staying in the EU and 48% against.

A Financial Times poll of polls gives it 48% to 46% in favour of 'Remain', but a final ComRes poll has 'Remain' eight points ahead at 54-46%, while the latest online poll by Populus shows remain with 55% of the vote and a 10-point lead over 'Leave'.

There are lots of variables, of course - 12% of voters are said to be still undecided and the weather may affect turnout. Opinion polls have a habit of getting it woefully wrong, too, but the bookies don’t like losing money, so what do they think?

Yesterday, 'Remain' was odds-on at 2-9, with 'Leave' has drifting out to 3-1 against. Most popular bets on Thursday, according to oddschecker.com, are 'Remain' at 1-7 and 'Leave' at 6-1. That puts the implied probability of Britain staying in the EU at 87.5%!

Square Mile gamblers are also placing huge bets on the UK's continued membership of the EU. The FTSE 100 was up as much as 119 points this morning at 6,380, its highest level since April 22 and an 8% gain in the past week. Last Thursday, the leading index was worth just 5,899.

Again, it's the usual suspects doing well. made it above 72p for the first time in three weeks, has just hit a one-month high and is at its highest since May. Sticking with the EU means an end to uncertainty around so-called 'passporting' - a UK bank's right to operate across Europe.

Since the 'Remain'-inspired recovery began last Wednesday, RBS is up almost 17%, Barclays 16% and Lloyds over 13%.

Housebuilders , and have clawed back sizeable 'Leave'-driven losses, too, up 11-12% in the past week. Even is doing well, extending a rally which coincided with our article Tesco tipped to surge 43% since when the share price is up over 11%.

In some welcome relief from the referendum circus, the supermarket reported this morning that UK like-for-like sales had risen 0.3% increase in the first quarter. It's the first time in at least five years the grocer has managed two consecutive quarters of growth. As predicted, and quite sensibly, it's also selling its Harris + Hoole coffee shops to Caffè Nero, part of the process of focusing the supermarket back on what it does best.

If both the polls and the bookies are right, expect a big celebration Friday morning. A relief rally is almost inevitable following four months of political debate which, in truth, has rarely left the school playground.

However, if 'Remain' does win, investor focus will likely switch back to lacklustre global economic growth, the slowdown in China, and threat of Donald Trump making it to the White House. That will be a real test not only for UK equities, but markets worldwide.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser

Editor's Picks